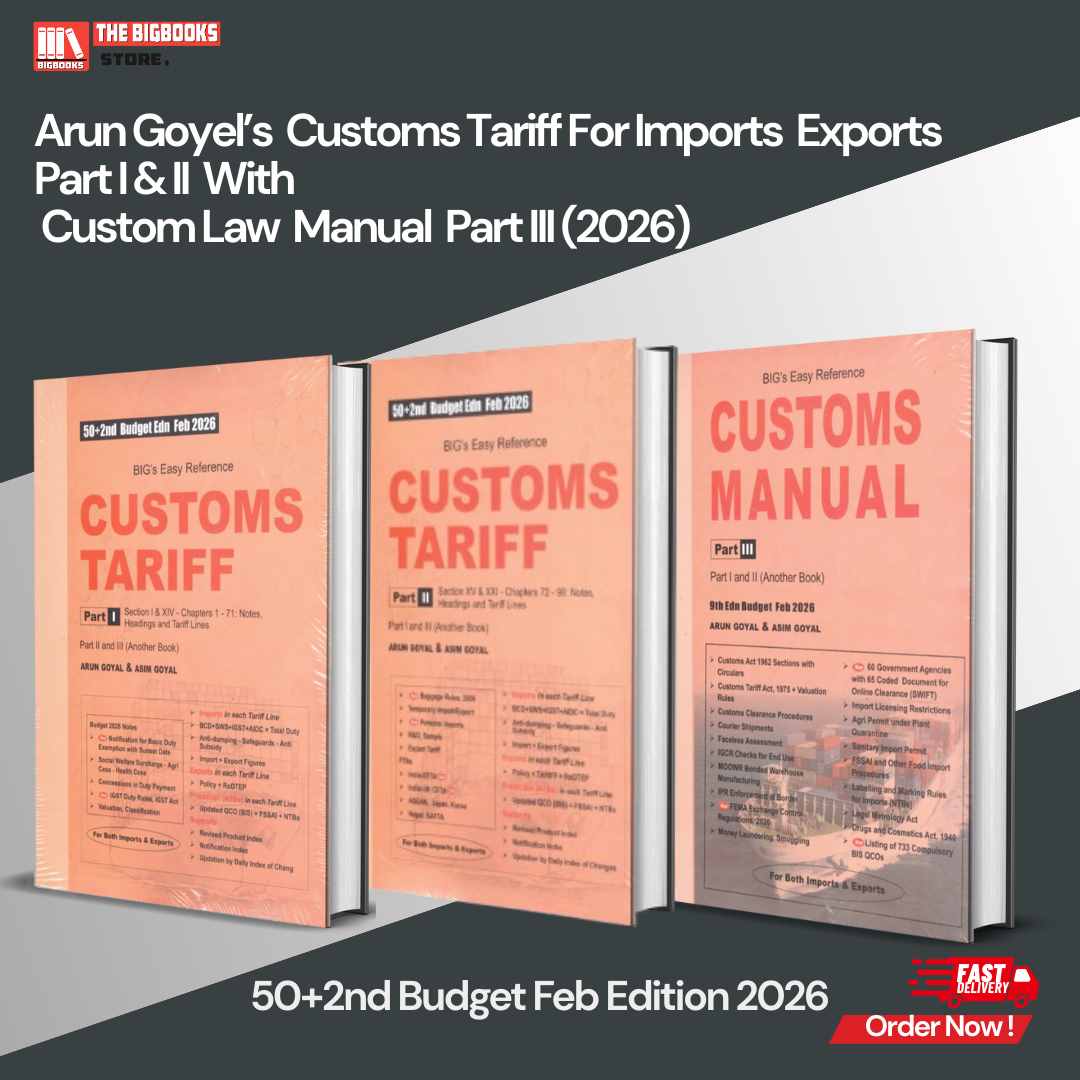

Arun Goyel’s Customs Tariff For Imports Exports Part I & II With Custom Law Manual Part III 50+2nd Budget Feb Edition 2026

| Author : | Arun Goyal |

|---|

A complete 3-part Customs reference set covering Customs Tariff for Imports & Exports (Part I & II) along with Customs Law Manual (Part III), updated as per the 50+2nd Budget February Edition 2026.

Arun Goyal’s Customs Tariff for Imports & Exports (Part I & II) with Customs Law Manual (Part III) – 50+2nd Budget February Edition 2026 is a comprehensive and authoritative Customs reference designed for practical application and legal clarity.

-

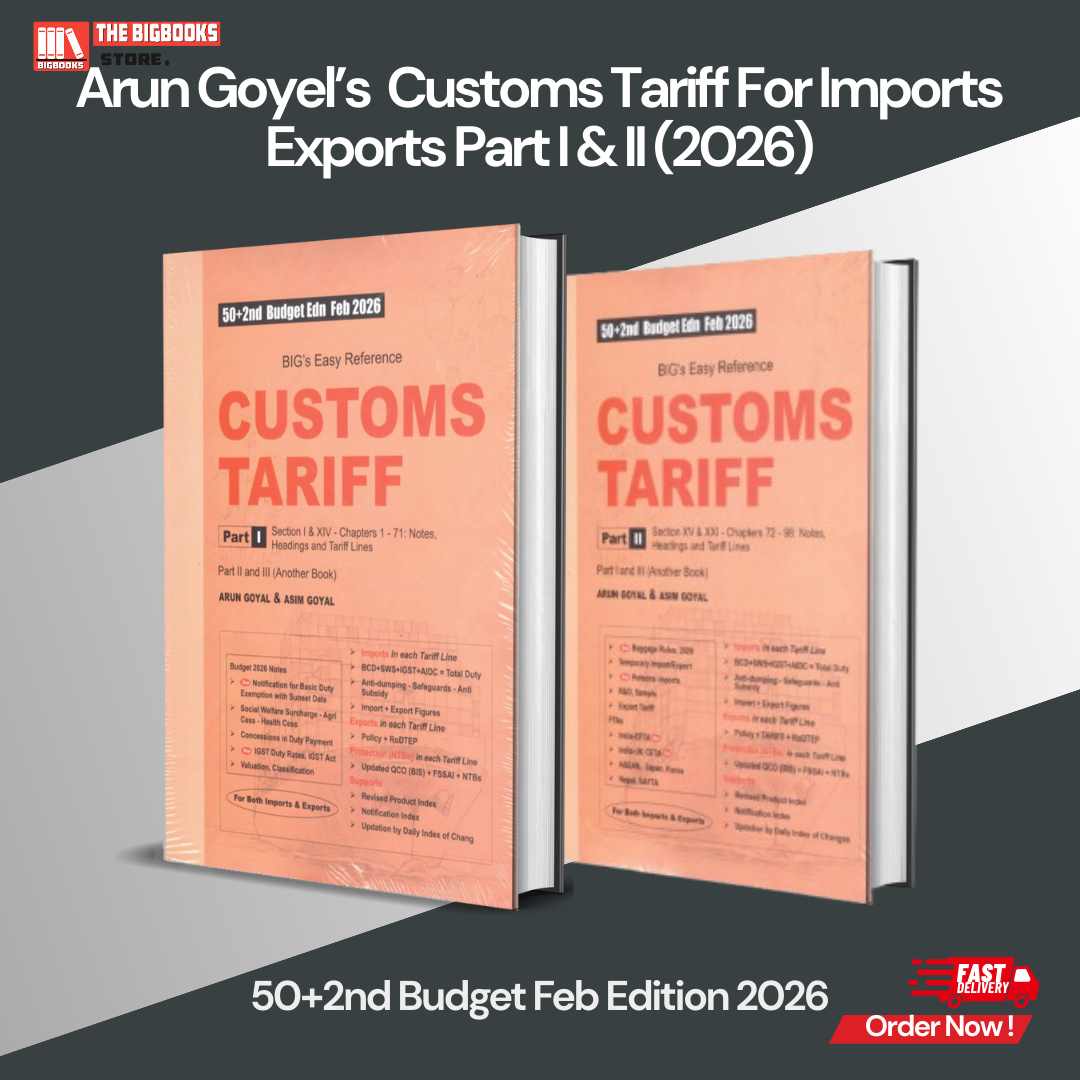

Part I & II cover the complete Customs Tariff for Imports and Exports, enabling accurate classification, duty calculation, and tariff interpretation.

-

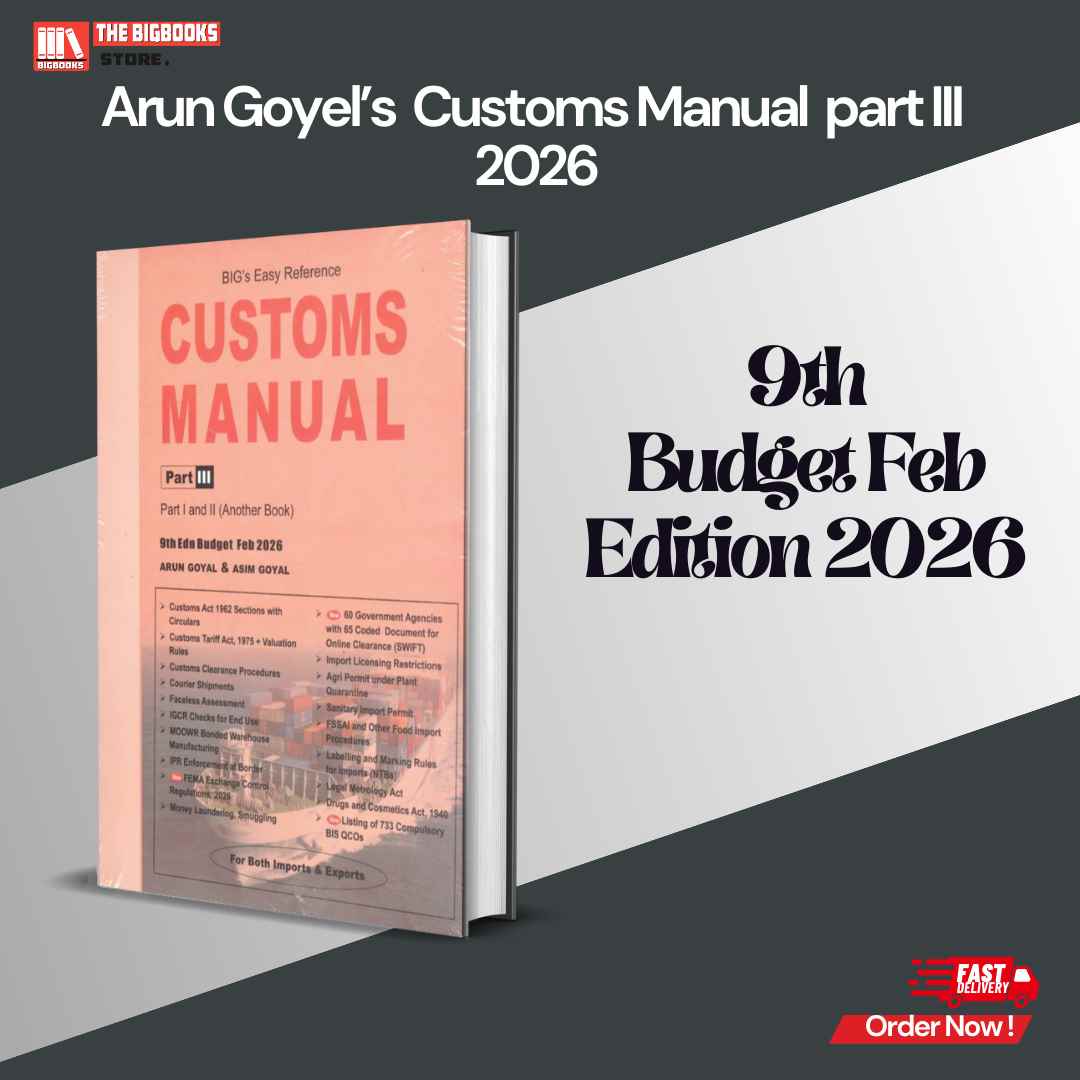

Part III – Customs Law Manual provides the Customs Act, allied rules, procedures, notifications, and circulars, offering a strong legal foundation for compliance and advisory work.

Updated as per the Union Budget 2026, Finance Act amendments, and latest CBIC notifications, this publication serves as a one-stop solution for professionals engaged in import-export operations, customs assessments, audits, and litigation.

Widely used by customs brokers, CA, advocates, importers, exporters, logistics professionals, and students of indirect taxation, this set remains a trusted industry reference.

🔍 Key Features:

-

3-part comprehensive Customs reference

-

Customs Tariff for Imports & Exports (Part I & II)

-

Customs Law Manual included (Part III)

-

Updated as per 50+2nd Budget February 2026

-

Ideal for classification, compliance, audits & litigation