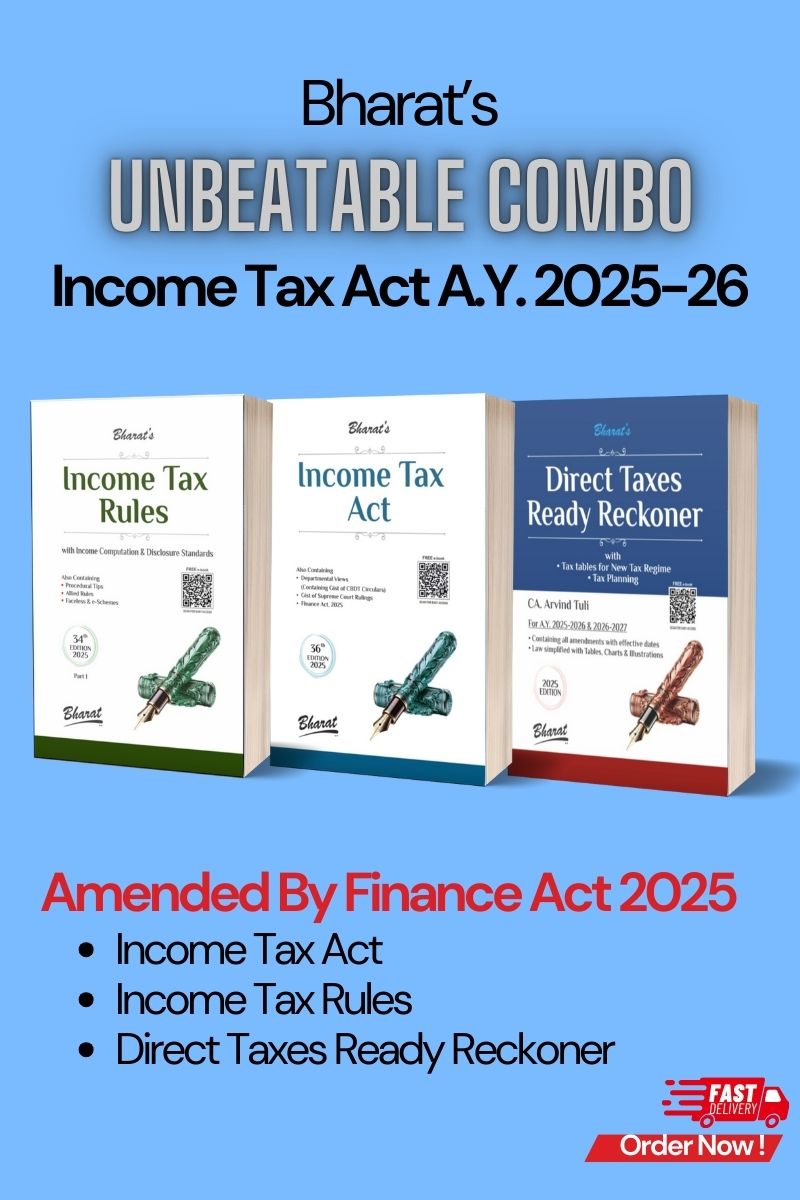

Bharat Combo of 3 – Income Tax Act A.Y. 2025-26 (Amended by Finance Act, 2025)

Tags: Taxation, Tax Planning, Direct Taxes Ready Reckoner, New Finance Act, 2025-2026, Income Tax Bill, Income Tax Rules

Bharat’s Combo of 3 – Income Tax Act A.Y. 2025-26(Amended by Finance Act, 2025)

The Bharat Combo of 3 – Income Tax Act A.Y. 2025-26 is an essential tax reference set, providing a complete and updated compilation of the latest Income Tax provisions applicable for Assessment Year 2025-26. This set is designed for chartered accountants, tax professionals, corporate finance teams, legal experts, and students who require a detailed yet practical understanding of India’s direct tax system.

What’s Included in This Comprehensive Combo?

1. Income Tax Act (Amended by Finance Act, 2025)

• Updated text of the Income Tax Act, 1961, incorporating all latest amendments and revisions.

• Section-wise legal interpretations, case laws, and expert commentaries for practical application.

• Analysis of key changes in tax provisions, along with their implications for taxpayers and businesses.

2. Income Tax Rules

• Complete rules governing the Income Tax Act, ensuring clear procedural compliance.

• Includes the latest amendments, circulars, notifications, and clarifications issued by CBDT.

• Step-by-step procedural guidance for tax computation, return filing, assessments, and appeals.

3. Direct Taxes Ready Reckoner

• A quick-reference guide for direct tax laws applicable for A.Y. 2025-26.

• Covers tax rates, deductions, exemptions, and compliance procedures in an easy-to-understand format.

• Designed for fast decision-making, making it an essential tool for tax practitioners and businesses.

Why Choose Bharat’s Combo of 3?

✔ Fully Updated & Amended – Incorporates all latest amendments introduced in Finance Act, 2025.

✔ Comprehensive & Reliable – Covers all essential tax provisions, rules, and procedural requirements.

✔ Trusted by Professionals – Recommended for CAs, tax consultants, corporate accountants, and legal practitioners.

✔ Simplifies Tax Compliance – Provides practical insights and expert interpretations for hassle-free tax planning.

✔ Ideal for Exam Preparation – A must-have for CA, CS, CMA, and law students specializing in taxation.

Stay ahead with Bharat’s Combo of 3 – Income Tax Act A.Y. 2025-26 – your ultimate tax reference set for direct tax compliance and strategic tax planning.

Available now at The BigBooks Store – Your trusted source for premium taxation and legal books!

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)