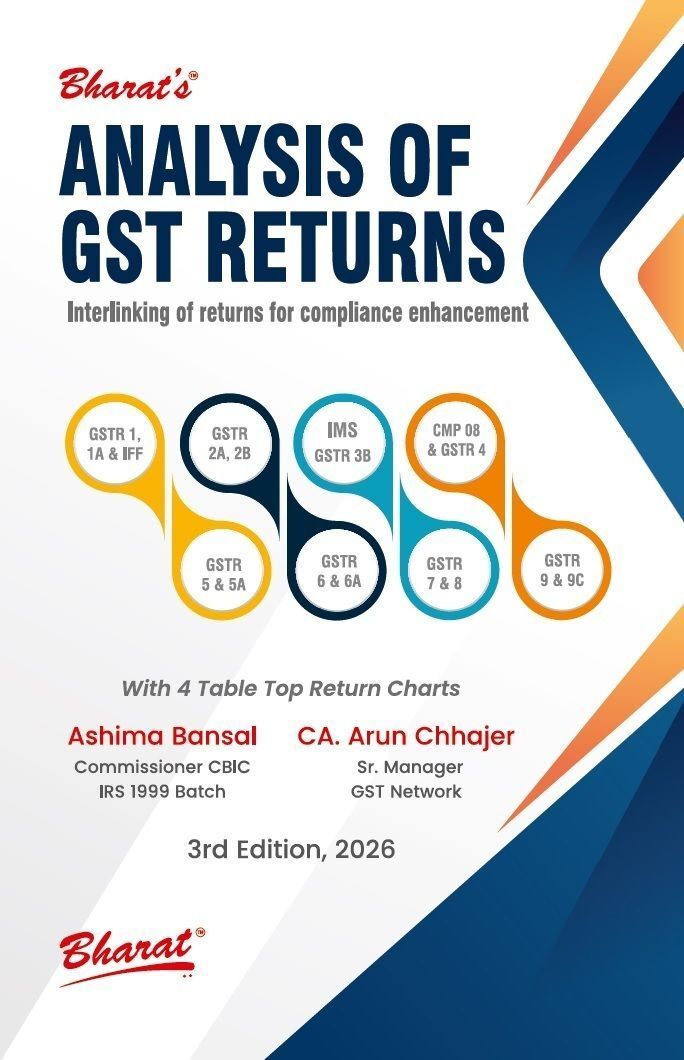

Bharat's Analysis Of GST Returns - 2nd Edition 2025

| Author : | Ashima Bansal, CA. Arun Chhajer |

|---|

485

English

2nd Edition 2025

Tags: PROFESSIONAL BOOKS, • TAXATION, GST Books

Bharat's Analysis of GST Returns

Bharat's Analysis of GST Returns – 2nd Edition, 2025 is a thoroughly updated and practical guide dedicated to the preparation, filing, and analysis of Goods and Services Tax (GST) returns under Indian tax law. Written by subject-matter experts, this edition incorporates the latest legal updates, circulars, and procedural changes as per the CGST Act, Rules, and Notifications up to 2025, including the latest changes introduced through the Union Budget and GST Council recommendations.

This book offers readers a detailed and structured approach to understanding all types of GST returns—monthly, quarterly, annual, and reconciliation-based. It is tailored for GST practitioners, Chartered Accountants, tax consultants, businesses, and students preparing for professional examinations or seeking in-depth understanding of return-filing mechanisms under GST.

Key Features:

-

✅ Complete Coverage of GST Returns: Explains in detail each return form such as GSTR-1, GSTR-3B, GSTR-4, GSTR-5, GSTR-6, GSTR-7, GSTR-9, and GSTR-9C with compliance checklists and filing procedures.

-

✅ Reconciliation Techniques: Focuses on 2A/2B vs. 3B reconciliation, invoice matching, and annual return reconciliation with real-life scenarios and tips to resolve common mismatches.

-

✅ Updated as per Latest Changes: Covers the latest GST portal updates, new filing timelines, QRMP scheme implementation, and recent government notifications relevant to return filing.

-

✅ Compliance-Oriented Approach: Details interest, late fees, penalties, and consequences of incorrect or delayed return filings, including best practices to avoid notices and audits.

-

✅ Industry-Specific Guidance: Provides illustrative return filing models for sectors like manufacturing, services, trading, exports, e-commerce, and small businesses under composition schemes.

-

✅ Practical Formats and Templates: Includes sample return formats, calculation sheets, and filing illustrations to help readers prepare accurate and compliant returns.

-

✅ Annual & Final Returns: Special emphasis on the Annual Return (GSTR-9) and Audit Reconciliation Statement (GSTR-9C) with disclosures and audit trail requirements.

Why This Book is Essential:

-

🔹 Bridge Between Law & Practice: Designed for practical implementation of return provisions rather than theoretical analysis, making it ideal for on-ground professionals.

-

🔹 Compliance-Driven Resource: Helps readers avoid legal pitfalls and non-compliance through thorough understanding of filing obligations and corrective actions.

-

🔹 Updated with 2025 Framework: Incorporates all changes up to the current assessment year and recent administrative instructions from CBIC and GSTN.

-

🔹 Ideal for Various User Segments: A must-have tool for business owners, tax consultants, finance managers, students, and legal advisors working in the field of indirect taxation.

-

🔹 GST Practitioner’s Trusted Companion: Widely used by GST return preparers, this guide serves as a ready reference for daily return-related queries and issues.

Bharat's Analysis of GST Returns – 2nd Edition, 2025 is an indispensable guide to mastering the return filing framework under GST in India. Whether you are a beginner or an experienced professional, this book provides a clear path to compliant and efficient GST return filing in today's fast-evolving regulatory landscape.