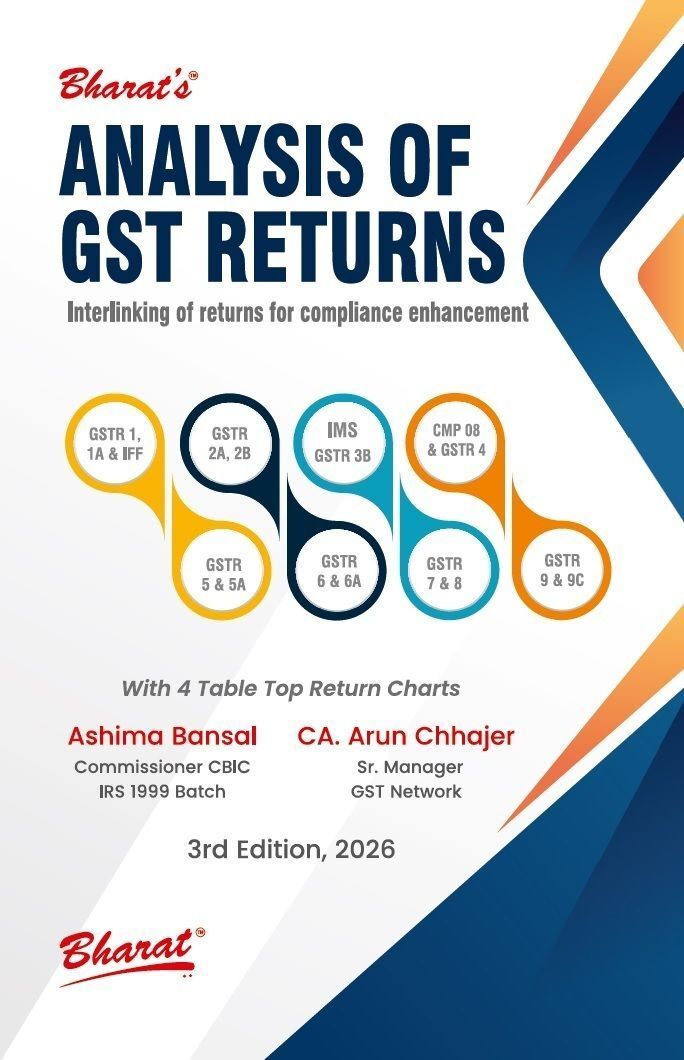

Bharat's Analysis of GST Returns Interlinking of returns for compliance enhancement With Chart - 3rd Edition 2026

| Author : | Ashima Bansal |

|---|

Bharat’s Analysis of GST Returns: Interlinking of Returns for Compliance Enhancement – 3rd Edition 2026 offers a practical and in-depth explanation of the interlinking mechanism of GST returns under the Indian GST regime. This updated edition explains the relationship between GSTR-1, GSTR-2A/2B, GSTR-3B, GSTR-9, and GSTR-9C, highlighting common errors, mismatches, and their compliance implications.

The book provides step-by-step guidance on reconciliation, input tax credit (ITC) verification, error rectification, and departmental scrutiny. It is especially useful for chartered accountants, tax practitioners, GST consultants, auditors, and businesses seeking accurate GST compliance and risk mitigation.

GST returns interlinking book, analysis of GST returns India, GSTR-1 GSTR-3B reconciliation, GST compliance enhancement, GST return filing guide 2026, GST mismatch resolution, input tax credit reconciliation, GST audit and assessment book, Bharat GST law book, GST practical guide IndiaBharat’s Analysis of GST Returns: Interlinking of Returns for Compliance Enhancement – 3rd Edition 2026 offers a practical and in-depth explanation of the interlinking mechanism of GST returns under the Indian GST regime. This updated edition explains the relationship between GSTR-1, GSTR-2A/2B, GSTR-3B, GSTR-9, and GSTR-9C, highlighting common errors, mismatches, and their compliance implications.

The book provides step-by-step guidance on reconciliation, input tax credit (ITC) verification, error rectification, and departmental scrutiny. It is especially useful for chartered accountants, tax practitioners, GST consultants, auditors, and businesses seeking accurate GST compliance and risk mitigation.