Commercial’s Direct Taxes Ready Reckoner with Tax Planning- 26th Edition, 2025

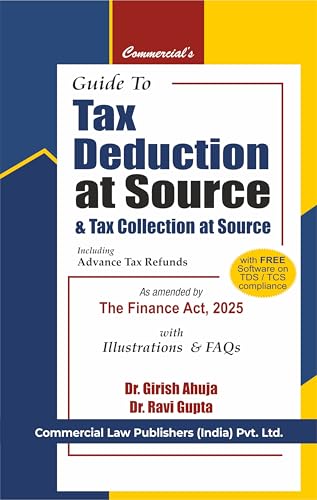

| Author : | DR. GIRISH AHUJA, DR. RAVI GUPTA |

|---|

1049

English

26th Edition

Tags: • TAXATION, Direct and Indirect Taxation, Direct Tax Law Manual, Company Act, Direct Taxes Ready Reckoner, New Finance Act, 2025-2026, Income Tax Bill, Income Tax Rules

Commercial’s Direct Taxes Ready Reckoner with Tax Planning | 26th Edition 2025 by Dr. Girish Ahuja & Dr. Ravi Gupta

Commercial’s Direct Taxes Ready Reckoner with Tax Planning (26th Edition, 2025) is a comprehensive and up-to-date reference guide covering the latest provisions of Income Tax, Tax Planning strategies, and recent amendments as per the Finance Act, 2024. This book is an essential resource for tax professionals, chartered accountants, business owners, corporate tax planners, and students preparing for taxation-related exams.

Key Features:

✔ Updated with the latest amendments introduced in the Finance Act, 2024.

✔ Covers Income Tax provisions in-depth, including capital gains, deductions, exemptions, and tax computation.

✔ Detailed Tax Planning strategies for individuals, businesses, and corporates to optimize tax liabilities.

✔ TDS, TCS, Advance Tax, and GST implications explained with practical scenarios.

✔ Includes e-filing procedures, compliance checklists, and case laws for better understanding.

✔ Simplified tables, flowcharts, and illustrations to enhance comprehension.

✔ Ideal for tax consultants, professionals, corporate accountants, and students appearing for CA, CS, CMA, and other taxation-related exams.

Stay ahead in taxation and planning with this authoritative guide. Get your copy today from The BigBooks Store – your trusted source for professional and legal books.