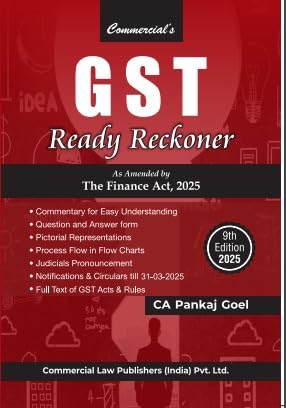

Commercial's GST Ready Reckoner - 9th Edition 2025

| Author : | CA PANKAJ Goel |

|---|

1664

English

9th Edition, 2025

Tags: Financial and Cost Accounting, GST Books, Budget Edition 2026, GST Ready Rechoner, GST Manual (Act & Rules)

Commercial's GST Ready Reckoner

Commercial's GST Ready Reckoner – 9th Edition, 2025 is a thoroughly updated and practical handbook that provides a concise and structured analysis of India’s Goods and Services Tax (GST) framework. Tailored for professionals, businesses, consultants, and students, this edition brings clarity to the complex legal structure of GST through its well-organized content, real-life illustrations, and expert guidance. It incorporates all the amendments introduced by the Finance Act, 2025, circulars, CBIC notifications, and important judicial rulings till date.

This book is an indispensable reference tool for day-to-day GST compliance, covering essential topics like input tax credit, time of supply, place of supply, reverse charge mechanism, GST returns, and e-invoicing. The reader-friendly layout, section-wise commentary, and practical insights make it a preferred choice among tax professionals and practitioners.

Key Features:

-

✅ Updated with Finance Act, 2025: Incorporates all statutory amendments, latest rules, notifications, circulars, and clarifications till April 2025.

-

✅ Comprehensive Coverage of GST Law: Includes CGST, SGST, IGST, UTGST, Compensation Cess, GST Rules, and relevant case laws.

-

✅ Section-wise & Rule-wise Analysis: Detailed interpretation of each section and rule under the GST Act, supported with practical examples and recent developments.

-

✅ Focused Coverage of Critical Topics: Includes updated content on e-invoicing, ITC restrictions, QRMP scheme, GST on e-commerce, and returns like GSTR-1, GSTR-3B, GSTR-9, and GSTR-9C.

-

✅ Reverse Charge & Exemptions Simplified: Tabular listing of goods/services under RCM and exemptions for easy compliance.

-

✅ Practical Checklists & Compliance Tools: Return filing calendars, due date reminders, penalty charts, and FAQs for ready reference.

-

✅ Judicial Precedents & Interpretative Guidance: Includes relevant case laws and decisions for better understanding of legal interpretations.

Why This Book is Essential:

-

🔹 Trusted by Professionals: A go-to reference for Chartered Accountants, GST consultants, lawyers, and corporate tax teams.

-

🔹 Perfect for Students & Exam Preparation: Beneficial for students of CA, CS, CMA, and law, offering easy-to-grasp content for exam revision.

-

🔹 Helps Ensure Error-Free Compliance: Step-by-step procedural guidance and clarification on complex provisions help users avoid costly mistakes.

-

🔹 Quick Access Format: User-friendly design with summary tables, flowcharts, and bullet points for fast reading and understanding.

-

🔹 Covers Practical Aspects in Depth: Designed to support practical application of the GST law with real-world relevance.

Commercial's GST Ready Reckoner – 9th Edition, 2025 is an essential desktop reference for anyone involved in GST advisory, filing, litigation, or education. Whether you’re a tax professional, business owner, compliance officer, or student, this book equips you with updated legal knowledge, interpretative clarity, and actionable insights to confidently navigate the GST regime in India.