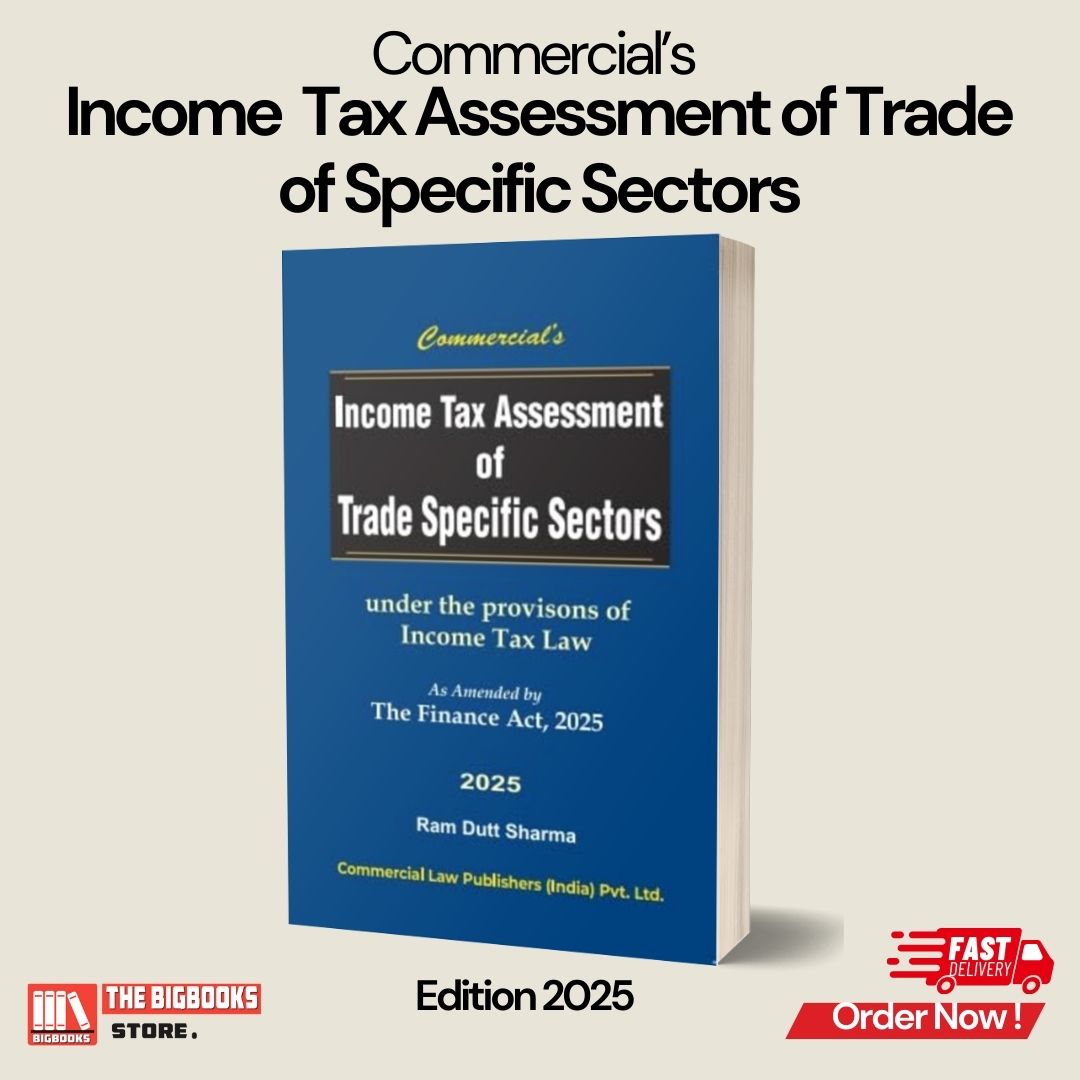

Commercial's Income Tax Assessment of Trade Specific Sectors Under the Provisions of Income Tax Law As Amended by The Finance Act, 2025

| Author : | RAM DUTT SHARMA |

|---|

Commercial’s Income Tax Assessment of Trade Specific Sectors Under the Provisions of Income Tax Law As Amended by The Finance Act, 2025

Edition: 2025

Binding: Paperback

This comprehensive guide to income tax assessment for trade-specific sectors under the provisions of the Income Tax Law explores the latest amendments made by the Finance Act, 2025. It provides professionals, tax consultants, and businesses with a detailed understanding of how income tax law applies to various industries. The book offers a practical approach to assessing taxes for sectors such as manufacturing, services, retail, and more, with clear explanations of relevant provisions, case studies, and compliance strategies.

Key Features:

• Sector-Specific Tax Assessment: Detailed analysis of income tax provisions applicable to trade-specific sectors like manufacturing, retail, agriculture, services, and more.

• Latest Amendments Included: Incorporates the latest changes made by the Finance Act, 2025, including adjustments in tax rates, exemptions, and deductions across different industries.

• Practical Compliance Guidance: Provides step-by-step procedures for ensuring compliance with the Income Tax Act, including methods for calculating taxable income and deductions for each sector.

• Case Studies and Examples: Includes real-world case studies and practical examples to help readers understand the application of income tax laws across various industries.

• Comprehensive Tax Planning Strategies: Offers insights into how businesses can optimize their tax liabilities through efficient tax planning tailored to their sector.

• Detailed Tax Provisions: Thorough explanation of key provisions, including exemptions, deductions, and specific rules for different trade sectors, helping businesses understand the impact on their operations.

• Clear Legal Framework: Examines the legal framework governing income tax assessment, highlighting compliance requirements, audits, and the appeals process for trade-specific sectors.

Why This Book is Essential:

• In-Depth Sectoral Analysis: Perfect for tax professionals and business owners who need detailed insights into income tax assessment for specific industries.

• Updated with the Latest Finance Act Amendments: Ensures that readers are fully informed about the latest legal changes affecting tax assessments and business operations.

• Practical Resource for Tax Compliance: Offers actionable strategies for complying with the provisions of the Income Tax Act, making it an indispensable resource for businesses looking to optimize their tax processes.

• Comprehensive for Professionals and Students: Ideal for chartered accountants, tax consultants, legal professionals, and students preparing for competitive exams in taxation and finance.

• Helps in Strategic Tax Planning: Provides valuable strategies for businesses to minimize their tax liabilities and stay compliant, making it a practical tool for financial planning and decision-making.

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)