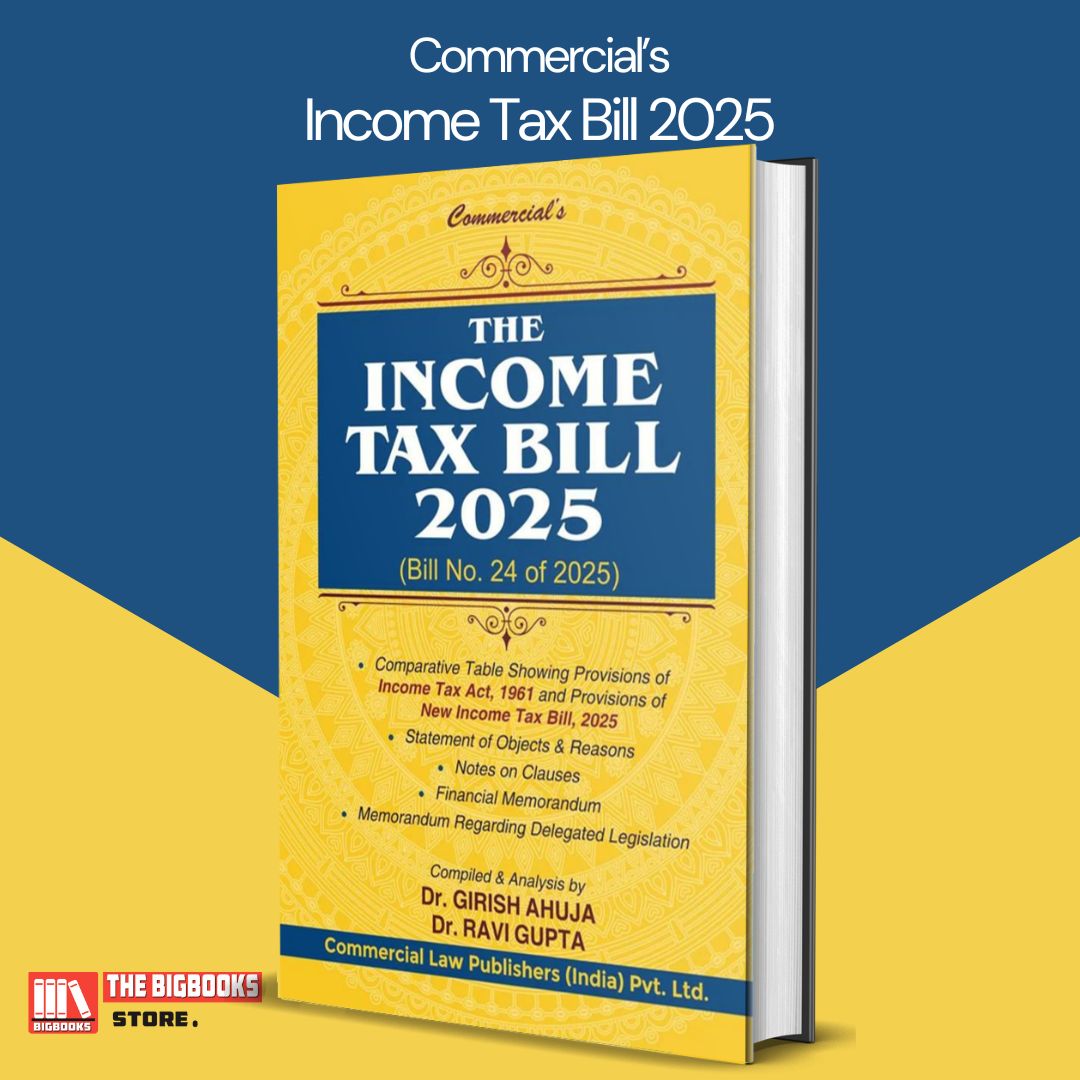

Commercial's The Income Tax Bill 2025 - 1st Edition 2025

| Author : | DR. GIRISH AHUJA, DR. RAVI GUPTA |

|---|

685

English

1st Edition 2025

Tags: PROFESSIONAL BOOKS, • TAXATION, Income Tax, Income Tax, New Finance Act, 2025-2026, Budget Edition 2025, Income Tax Bill

Commercial’s The Income Tax Bill 2025 | 1st Edition 2025

“Commercial’s The Income Tax Bill 2025” is a comprehensive and up-to-date guide providing a detailed analysis of India’s proposed new Income Tax Bill, 2025. This book is an essential resource for tax professionals, chartered accountants, legal practitioners, finance experts, corporate executives, academicians, and students who want to understand the proposed changes, their implications, and the future of India’s tax system.

Key Features:

✅ Complete Coverage of the Income Tax Bill, 2025

• Provides a section-wise and clause-wise breakdown of the proposed tax law.

• Explains key differences between the Income Tax Bill, 2025, and the Income-tax Act, 1961.

• Discusses the rationale and legislative intent behind the major provisions.

✅ Comparative Analysis with the Existing Tax Regime

• Highlights significant changes in tax rates, exemptions, deductions, and compliance requirements.

• Explains the impact of the transition from the old tax structure to the proposed framework.

• Analyzes how businesses, salaried individuals, and taxpayers will be affected.

✅ Notes on Clauses & Expert Interpretations

• Offers clause-by-clause commentary, simplifying complex legal and financial terms.

• Expert insights and interpretations on potential ambiguities and compliance strategies.

• Discusses key amendments, government policies, and tax administration reforms.

✅ Practical Implications & Case Studies

• Real-world examples and case laws to illustrate the effects of new provisions.

• Insights into how companies, startups, and individual taxpayers should prepare.

• Discussion on expected legal challenges, procedural hurdles, and compliance obligations.

✅ Latest Updates & Government Notifications

• Incorporates all recent announcements, budgetary changes, and press releases related to the new tax system.

• Includes comparative charts, tables, and illustrations to enhance understanding.

✅ Essential for Professionals, Academicians & Students

• Ideal for CA, CS, CMA, MBA (Finance), law students, and competitive exam aspirants.

• A must-have reference for tax consultants, corporate accountants, and policymakers.

With detailed explanations, in-depth analysis, and expert perspectives, this book is an authoritative guide to understanding the future of taxation in India. Whether you’re a professional navigating the tax landscape or a student preparing for exams, this book provides clarity, insight, and practical guidance on the Income Tax Bill, 2025.

📚 Stay ahead in taxation with the latest insights on India’s new Income Tax Bill!

🛒 Order now on The BigBooks Store! 🚀

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)