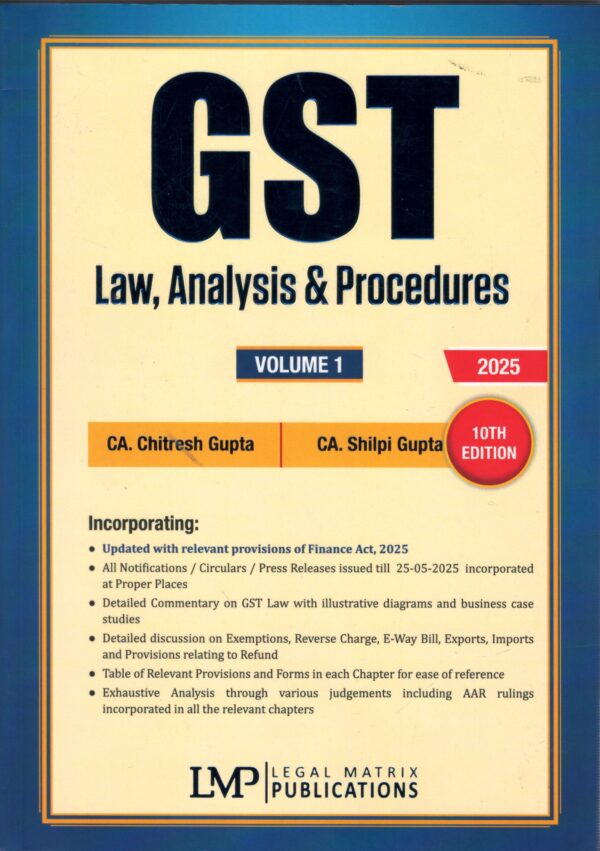

LMP’s GST Law, Analysis and Procedures (Set of 2 Vols) - 10th Edition 2025

LMP’s GST Law, Analysis and Procedures

LMP’s GST Law, Analysis and Procedures – 10th Edition 2025 (Set of 2 Volumes) is one of the most authoritative and up-to-date commentaries on the Goods and Services Tax in India. Designed to serve the evolving needs of tax practitioners, chartered accountants, legal advisors, and GST professionals, this work provides a clear, exhaustive, and actionable analysis of the GST framework, compliance requirements, legal provisions, and procedural formalities as applicable in 2025.

This edition has been fully updated as per the latest amendments under the Finance Act, 2025, and includes in-depth analysis of recent notifications, circulars, case laws, advance rulings, and judicial pronouncements. The book covers CGST, SGST, IGST, and UTGST Acts, rules, and forms with practical insights, procedural checklists, return filing guides, and real-world examples.

Both volumes are structured to offer easy navigation, and include flowcharts, tables, compliance charts, and FAQs to simplify understanding of complex provisions. The set is ideal for professionals engaged in tax litigation, compliance, audits, advisory, and consultancy services.

Key Features:

-

📘 Complete Two-Volume Set: Comprehensive coverage of GST Law, its implementation, and practical procedures across two well-organized volumes.

-

🔍 Updated as per Finance Act 2025: Incorporates all amendments introduced up to the Finance Act, 2025, with references to the latest rules and departmental clarifications.

-

📄 In-depth Procedural Guidance: Explains registration, invoicing, returns, e-way bills, refund claims, assessments, audits, penalties, and appeal mechanisms with examples.

-

⚖️ Legal Interpretation with Case Laws: Includes leading judicial decisions and advance rulings with analytical commentary to aid legal understanding and compliance.

-

📊 Tools for Practitioners: Contains charts, process maps, FAQs, and compliance checklists for fast reference and practical application.

-

📚 Segregated Act-wise Commentary: Covers CGST, SGST, IGST, Compensation Cess, and UTGST in a detailed, section-wise format with procedural illustrations.

-

🧾 Real-Life Scenarios & Use Cases: Practical illustrations showing application of GST in business scenarios, including supply chains, exports, real estate, and services.

-

✅ Applicable for Multiple Use Cases: Suited for use by GST consultants, CAs, tax advocates, businesses, law students, and in GST training programs.

Why This Book is Essential:

-

✅ Trusted Professional Guide: A go-to reference for GST practitioners and consultants dealing with compliance, audits, and litigation.

-

✅ Simplifies Complex Legal Provisions: Breaks down intricate sections of GST law with explanations, visuals, and use cases.

-

✅ Supports Day-to-Day GST Workflows: From registration to return filing and scrutiny response, this book helps streamline GST activities.

-

✅ Designed for Exam and Practice: Valuable for both students preparing for professional exams and practicing professionals handling client cases.

-

✅ Up-to-date, Practical, and Reliable: Authored by leading tax experts and reviewed thoroughly to reflect current law and practice.

LMP’s GST Law, Analysis and Procedures – 10th Edition 2025 (Set of 2 Volumes) stands out as a definitive guide to mastering the GST regime in India. Its rich analytical content, structured presentation, and updated insights make it an indispensable tool for anyone working in the indirect taxation landscape.