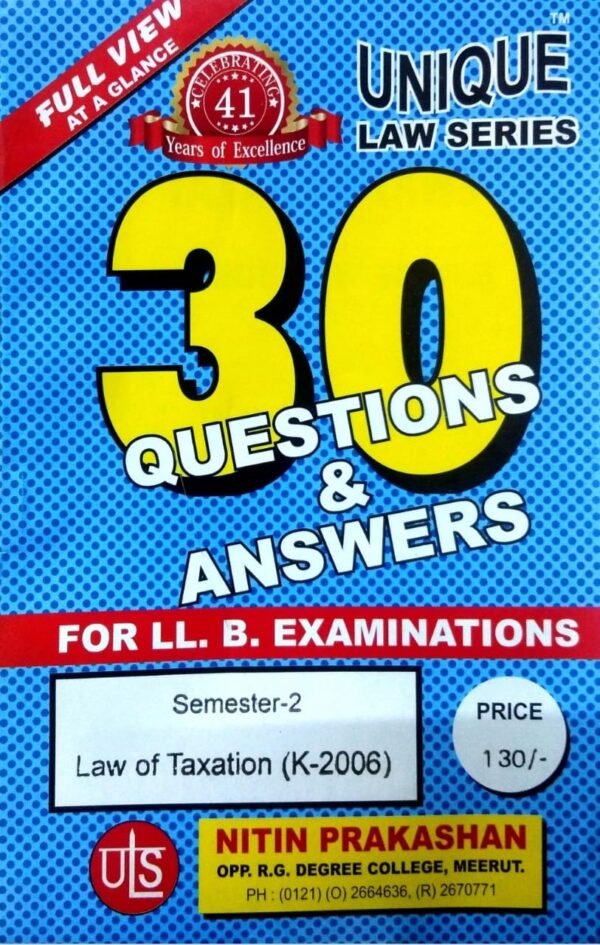

Nitin Prakashan Unique Law Series 30 Questions & Answers Semester-2 Law of Taxation (K-206) for LLB Exams - (English) Edition 2025

Nitin Prakashan Unique Law Series – 30 Questions & Answers – Semester-2 Law of Taxation (K-206) (English)

Nitin Prakashan’s Unique Law Series – 30 Questions & Answers on Law of Taxation (K-206) – Semester-2, Edition 2025 (English) is a comprehensive academic resource meticulously crafted to help LLB students master the fundamentals of taxation law in India. Designed specifically for Semester-2 law examinations, this book adopts a question-and-answer format, providing clarity, depth, and exam-oriented explanations on both Direct and Indirect Taxation principles.

Covering key topics from Income Tax Act, 1961, GST Act, 2017, and relevant judicial pronouncements, this book makes complex provisions accessible through simplified language and structured presentation. It is a highly recommended study companion for students preparing for LLB university exams, internal assessments, and competitive law entrance tests.

Key Features:

-

✅ 30 Most Expected Questions with Detailed Answers:

Thoughtfully selected and explained questions based on university trends to boost conceptual clarity and exam readiness. -

💼 Covers Key Concepts of Indian Taxation System:

Includes topics like tax structure in India, residential status, heads of income, tax exemptions, deductions, GST fundamentals, and taxable event analysis. -

📚 As per K-206 Syllabus & Updated Laws:

Fully aligned with the Semester-2 LLB Taxation Law syllabus and reflects the latest amendments and provisions up to FY 2024-25. -

🧾 Explains Direct & Indirect Taxation Separately:

Helps students distinguish clearly between the principles, procedures, and applications of income tax and GST. -

📖 User-Friendly Language & Structured Format:

Provides straightforward explanations and logical arrangement, making it easier to revise and retain key points before exams.