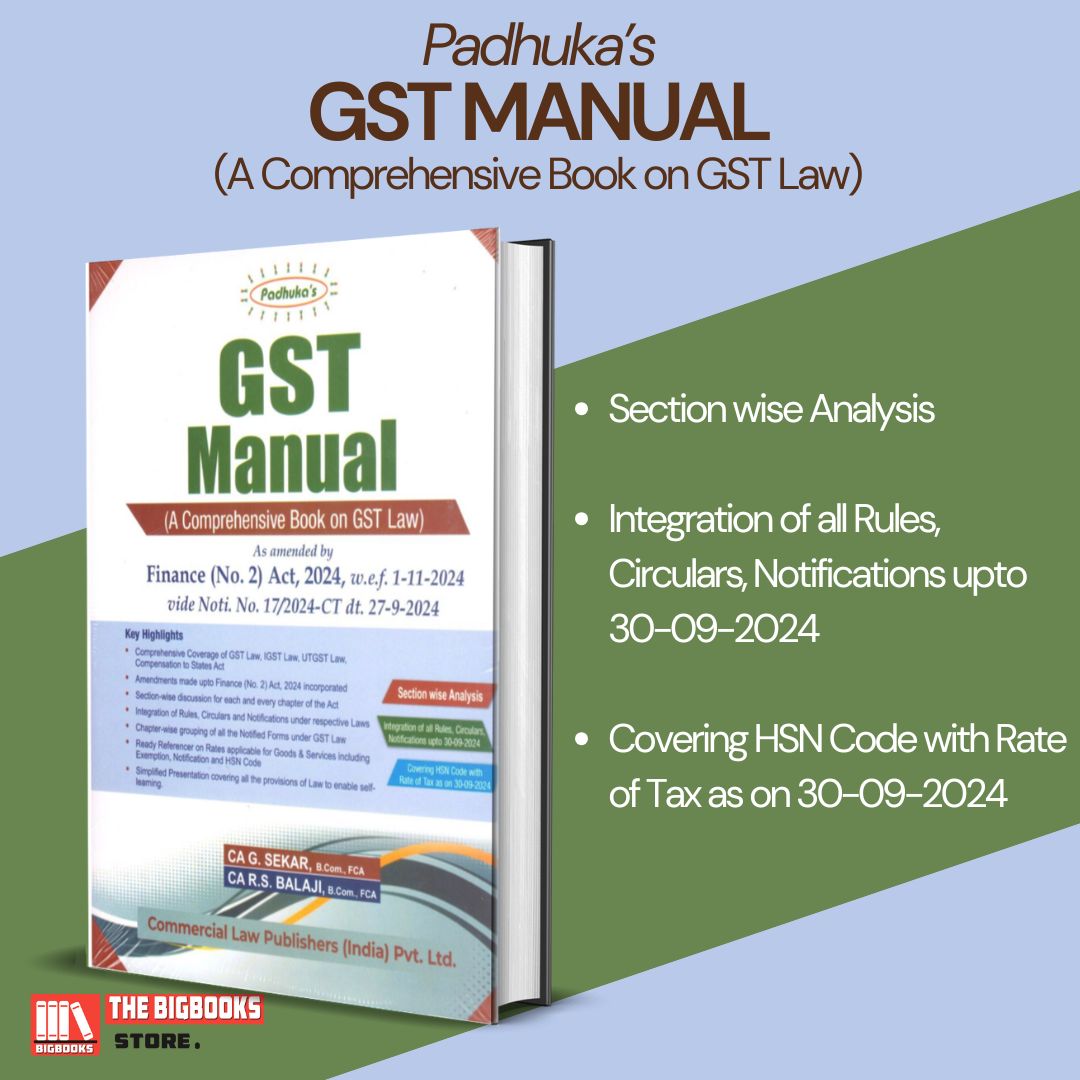

Padhuka's GST Manual, A Comprehensive Book on GST Law, As amended by Finance (No. 2) Act, 2024, w.e.f. 1-11-2024 Paperback – 24 October 2024

| Author : | CA R.S. BALA JI, B.COM., FCA |

|---|

Padhuka’s GST Manual – A Comprehensive Book on GST Law (As Amended by Finance (No. 2) Act, 2024, w.e.f. 1-11-2024)

Padhuka’s GST Manual is a detailed and updated guide covering all aspects of Goods and Services Tax (GST) law in India. This book provides an in-depth analysis of GST provisions, incorporating the latest amendments introduced by the Finance (No. 2) Act, 2024, effective from 1st November 2024. Designed for professionals, businesses, and students, this manual simplifies complex GST concepts, making it an essential resource for understanding, compliance, and practical application.

Key Features:

✅ Comprehensive Coverage of GST Law

• Detailed explanation of CGST, SGST, IGST, and Compensation Cess laws.

• Covers supply, input tax credit (ITC), tax invoices, registration, returns, and refunds.

• Discussion on GST rates, exemptions, and classification of goods & services.

✅ Updated with Latest Amendments

• Incorporates changes introduced by Finance (No. 2) Act, 2024, effective from 1st November 2024.

• Covers new compliance requirements, procedural updates, and tax rate modifications.

• Analysis of recent notifications, circulars, and case laws impacting GST.

✅ Step-by-Step Guide to GST Compliance

• Registration, return filing, and e-invoicing procedures explained in a simple manner.

• Practical insights on GST audits, assessments, and appeals.

• TDS/TCS provisions, penalties, and dispute resolution mechanisms covered in detail.

✅ GST Input Tax Credit & Tax Planning Strategies

• Detailed analysis of ITC eligibility, reversals, and conditions for claiming credits.

• Common errors in ITC claims and how to avoid them.

• Strategies for efficient tax planning under GST.

✅ Practical Case Studies & Illustrations

• Includes real-world case studies explaining GST implications in different business scenarios.

• Provides flowcharts, tables, and practical examples for better understanding.

• Comparative analysis of pre-GST and post-GST tax structures.

✅ Essential for Tax Professionals, Businesses & Students

• Ideal for chartered accountants, company secretaries, tax consultants, GST practitioners, and CFOs.

• Useful for business owners, corporate finance teams, and MSMEs to ensure smooth GST compliance.

• An excellent reference for law students and aspirants preparing for professional exams.

This book serves as a one-stop solution for GST law, ensuring readers are well-equipped with the latest legal framework and practical insights for seamless GST compliance and tax optimization.

📚 Stay ahead with the latest GST updates and expert guidance!

🛒 Order now on The BigBooks Store! 🚀