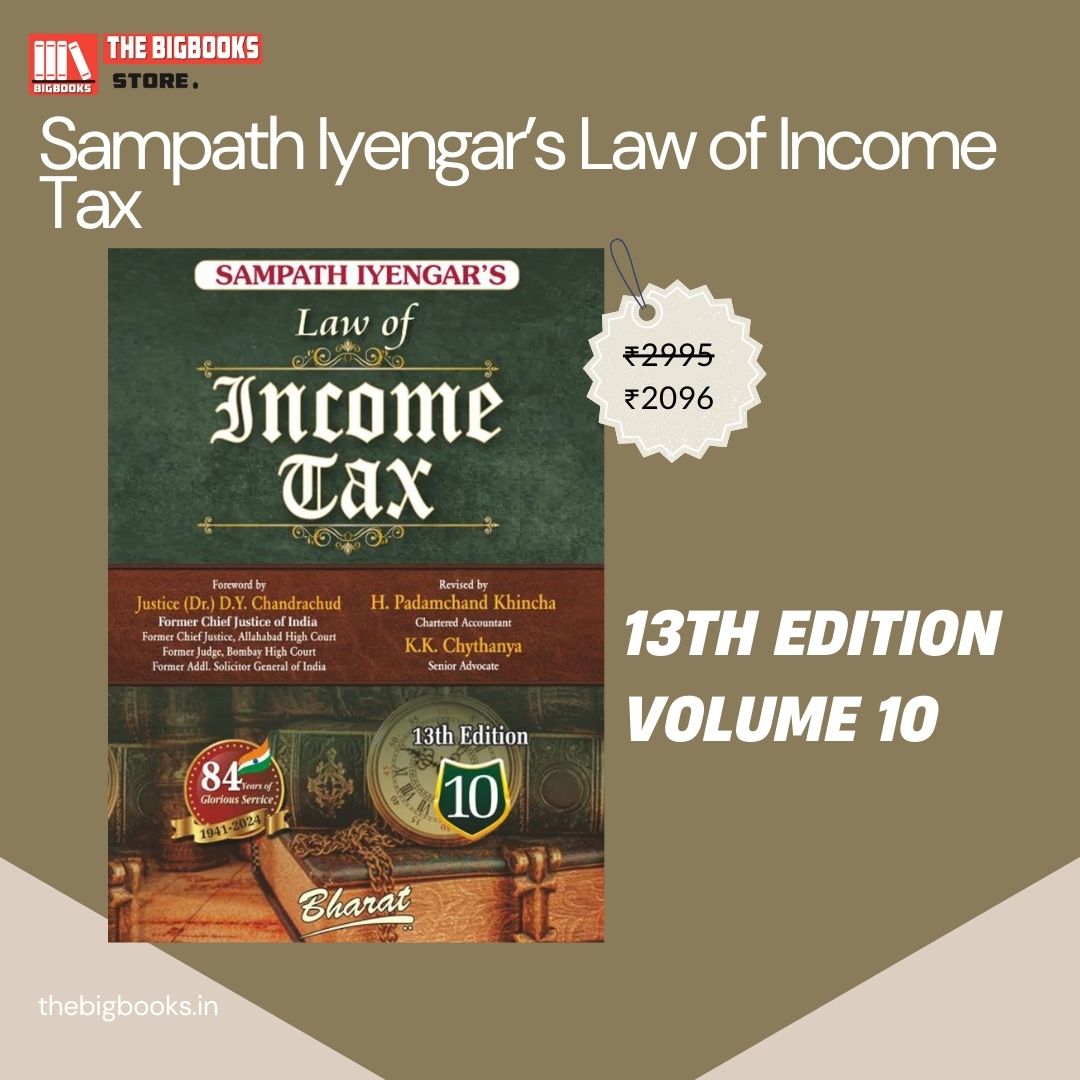

Sampath Iyengar’s Law of Income Tax, 10th Volume, 13th Edition 2024

| Author : | Sampath Iyengar |

|---|

2046

English

13th edition

Tags: Direct and Indirect Taxation, Taxation Law, Tax Audit, Tax Planning, Income Tax, Income Tax Bill

Sampath Iyengar’s Law of Income Tax, 10th Volume, 13th Edition 2024

Sampath Iyengar’s Law of Income Tax – 10th Volume is a definitive resource on Indian tax laws, providing a thorough and in-depth analysis of income tax provisions, judicial precedents, and legislative amendments. Published by Bharat, this volume is a part of the comprehensive Sampath Iyengar’s Law of Income Tax series, a trusted reference for tax professionals, chartered accountants, legal practitioners, and academicians.

This edition incorporates the latest amendments introduced through the Finance Act and provides a detailed discussion on key aspects of income tax law, including direct taxation principles, corporate tax provisions, international taxation, and procedural requirements. With an emphasis on landmark case laws, CBDT circulars, and tribunal decisions, the book ensures a practical and research-based understanding of taxation.

Key Features:

• Latest Legislative Updates – Covers recent amendments and tax policy changes affecting individuals, businesses, and multinational corporations.

• Judicial Precedents – Analyzes important rulings from the Supreme Court, High Courts, and ITAT, providing clarity on tax law interpretations.

• Corporate & Business Taxation – Discusses corporate tax liabilities, deductions, exemptions, and compliance under the latest regulatory framework.

• International Taxation & Transfer Pricing – Explores cross-border transactions, double taxation avoidance agreements (DTAAs), and global tax trends.

• Procedural and Compliance Aspects – Covers tax assessments, appeals, penalties, and dispute resolution mechanisms.

• Capital Gains & Tax Planning – Offers insights into capital gains taxation, exemptions, and investment planning strategies.

• GST and Direct Tax Interplay – Examines the implications of Goods and Services Tax on direct taxation.

This volume is an essential guide for professionals engaged in taxation, litigation, and compliance, offering comprehensive, up-to-date, and authoritative insights into the evolving landscape of Indian income tax law. Now available at The BigBooks Store.

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)