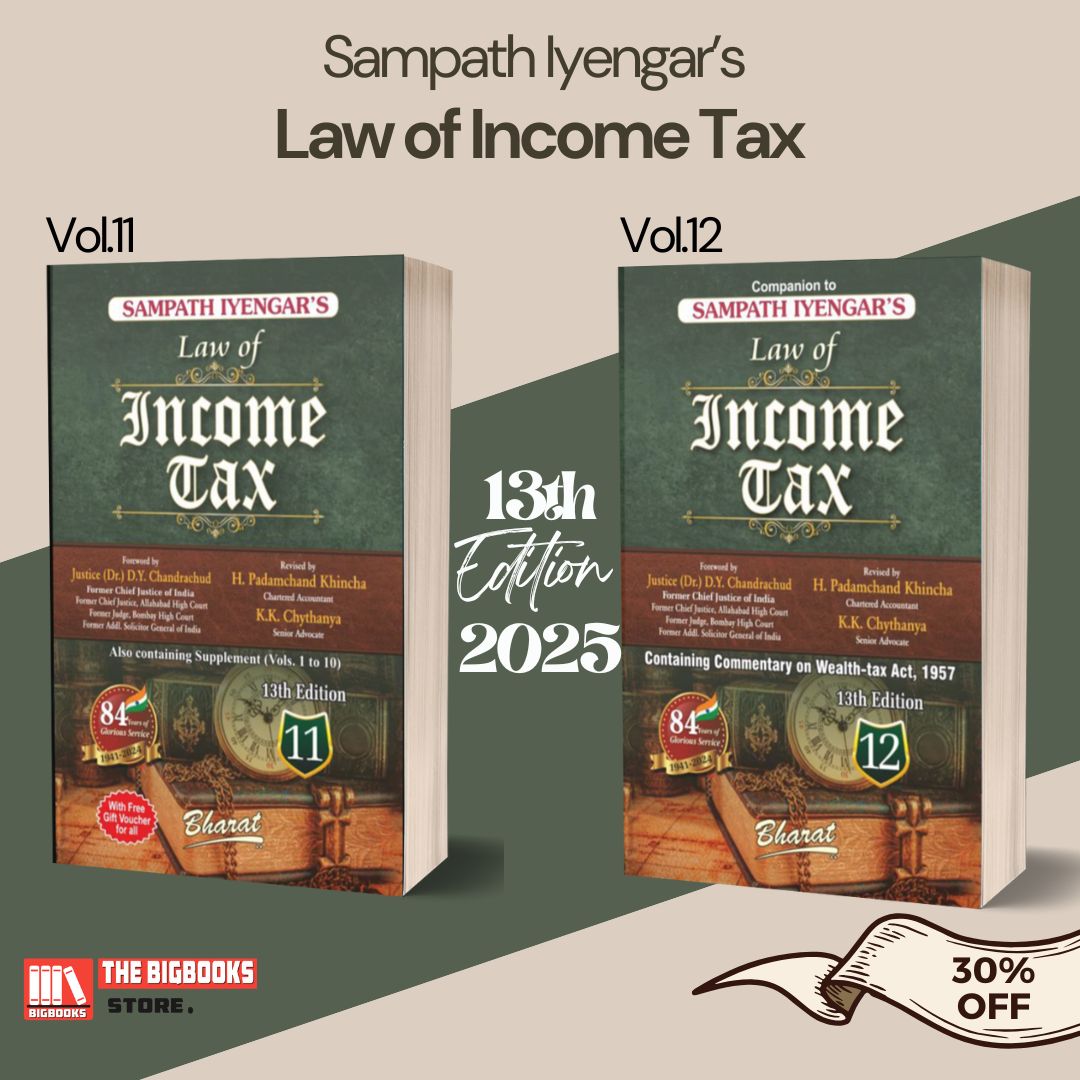

Sampath Iyengar’s Law of Income Tax, Volume 11 & 12, 13th Edition 2024

| Author : | Sampath Iyengar |

|---|

20640

English

13th Edition

Sampath Iyengar’s Law of Income Tax, Volume 11 & 12, 13th Edition 2024

Sampath Iyengar’s Law of Income Tax is an exhaustive and authoritative reference book that provides a detailed, section-wise analysis of Indian income tax laws, judicial rulings, and the latest amendments. Known for its clarity, depth, and practical approach, this set is an indispensable resource for chartered accountants, tax consultants, corporate professionals, legal practitioners, academicians, and tax researchers.

This two-volume set (Vol. 11 & 12) covers a wide range of topics, including tax assessments, appeals, penalties, international taxation, tax planning, and compliance strategies. The latest edition incorporates recent amendments under the Finance Act, landmark judgments, and government notifications, making it a comprehensive tax law guide for professionals dealing with direct taxation, corporate taxation, and legal compliance.

Key Features & Benefits:

✅ Exhaustive Coverage of Income Tax Laws & Provisions

• A detailed interpretation of income tax laws, explaining key provisions, exemptions, deductions, and tax liabilities.

• Practical guidance on tax compliance, filing, and legal considerations for individuals, businesses, and corporations.

• In-depth coverage of corporate taxation, tax audits, TDS/TCS provisions, and penalties.

✅ Updated with the Latest Amendments & Judicial Rulings

• Incorporates all recent amendments introduced under the latest Finance Act.

• Covers landmark Supreme Court, High Court, and ITAT rulings with detailed analysis and their impact on tax laws.

• Includes important CBDT circulars, notifications, and legal interpretations for practical application.

✅ Essential Reference for Tax Professionals & Legal Experts

• A must-have for chartered accountants, tax consultants, corporate tax teams, auditors, law firms, and financial analysts.

• Ideal for professionals handling tax assessments, appeals, compliance, and litigation.

• Provides expert insights into dispute resolution, tax planning strategies, and regulatory compliance.

✅ Practical Approach with Real-World Case Studies

• Detailed case law references to help professionals understand legal precedents and judicial interpretations.

• Step-by-step tax calculations, procedural aspects, and expert insights to help tax professionals make informed decisions.

• Guidance on handling complex tax situations, reducing tax liability legally, and avoiding litigation risks.

✅ User-Friendly Structure for Easy Reference

• Section-wise commentary and cross-references to ensure easy navigation.

• Tables, charts, and summary points to simplify complex tax provisions.

• Extensive indexing for quick access to relevant sections and tax provisions.

Why Should You Buy Sampath Iyengar’s Law of Income Tax (Vol. 11 & 12)?

📌 Most Trusted & Comprehensive Guide: This book is widely regarded as one of the most authoritative texts on Indian income tax laws.

📌 Essential for Tax Compliance & Planning: A must-have resource for ensuring accurate tax filing, compliance, and litigation strategies.

📌 Up-to-Date with Latest Legal Developments: Covers new amendments, rules, and judicial decisions, keeping professionals updated.

📌 Highly Recommended for CA, CS, and Legal Professionals: A key reference for CA Final, CS Professional, LLB, and tax law practitioners.

📚 Master Indian income tax laws with Sampath Iyengar’s Law of Income Tax – Your ultimate guide to taxation, compliance, and litigation!

🛒 Order now on The BigBooks Store and stay ahead in tax law expertise! 🚀

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)