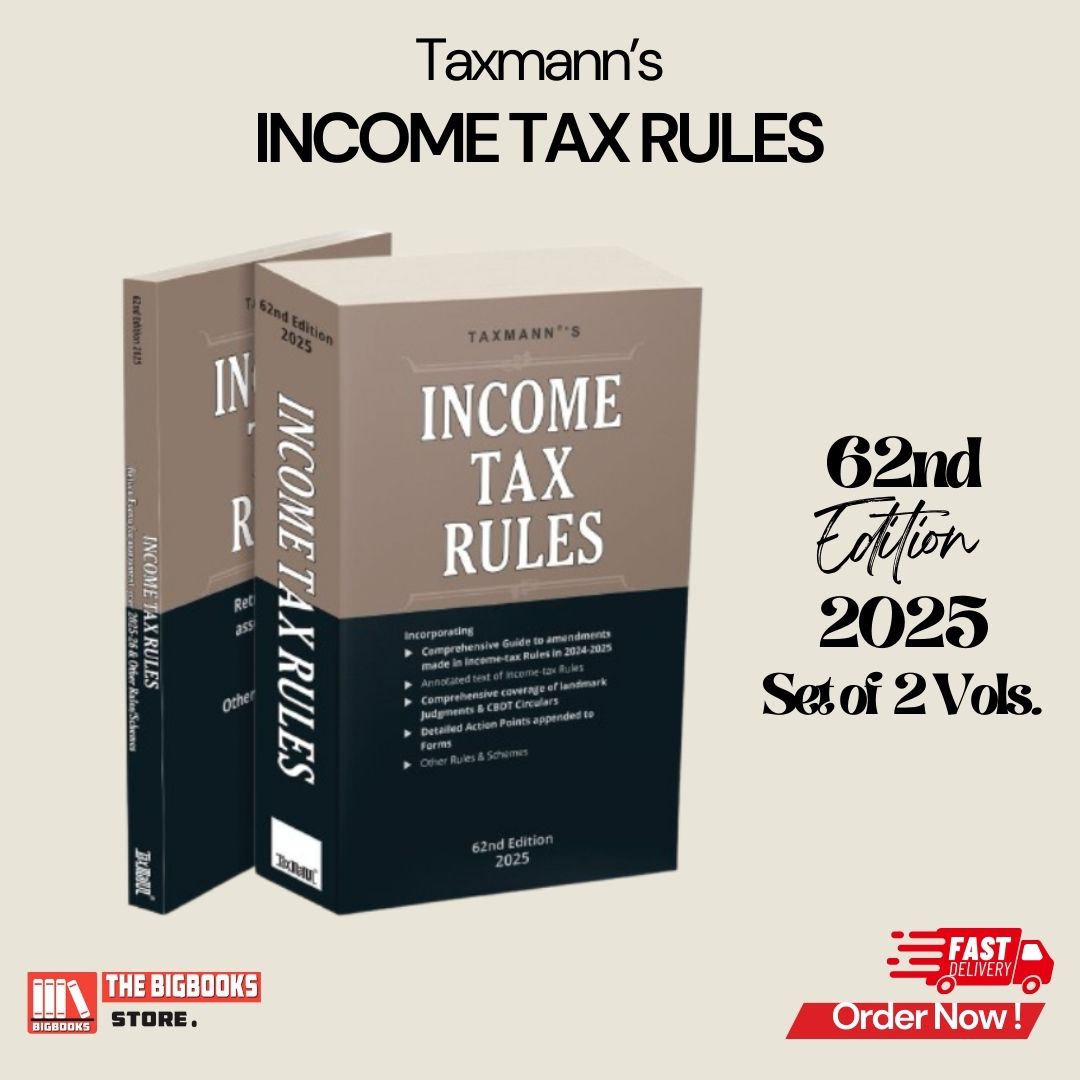

Taxmann’s Income Tax Rules, 62nd Edition 2025

Taxmann’s Income Tax Rules | 62nd Edition 2025

Taxmann’s Income Tax Rules (62nd Edition 2025) is a comprehensive and updated reference book that provides the latest Income Tax Rules, 1962, as amended by recent legislative changes, notifications, and circulars. This authoritative edition is essential for tax professionals, chartered accountants, legal practitioners, corporate finance teams, and students preparing for tax-related examinations.

This edition offers a structured and detailed presentation of income tax rules with a focus on compliance, procedural requirements, and practical applicability. The book provides a section-wise commentary along with illustrations, case laws, and explanatory notes to enhance understanding.

Key Features:

• Latest Amendments – Incorporates changes introduced through the Finance Act, 2025, and other statutory modifications.

• Section-wise Analysis – Detailed interpretation of Income Tax Rules, 1962, with cross-references to the Income Tax Act, 1961.

• Judicial Precedents & CBDT Notifications – Includes important case laws, circulars, and clarifications issued by the Central Board of Direct Taxes (CBDT).

• TDS & TCS Compliance – Covers comprehensive rules related to Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) with procedural guidelines.

• Advance Tax & Assessment Procedures – Discusses tax computation, advance tax payments, and assessment timelines.

• Tax Planning & Compliance – Provides guidance on deductions, exemptions, and tax-saving provisions under the latest tax framework.

• Illustrative Examples & Tables – Simplifies complex tax provisions with practical illustrations, tables, and flowcharts.

This 62nd Edition (2025) ensures that readers stay updated with the latest income tax rules, making it an indispensable guide for tax compliance and professional practice. Available now at The BigBooks Store.

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)