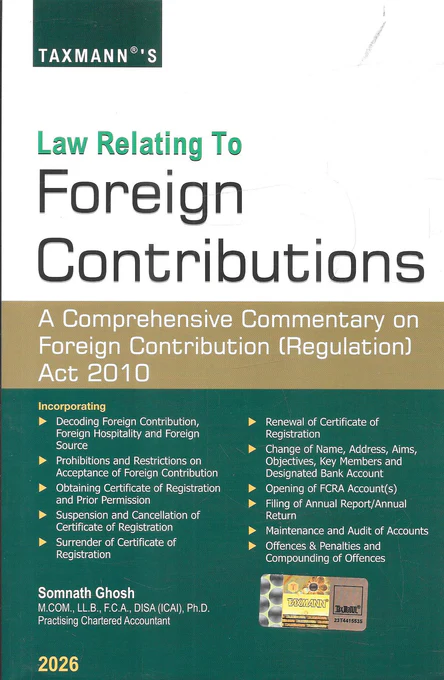

Taxmann's Law Relating to Foreign Contributions- Edition 2026

| Author : | Somanath Ghosh |

|---|

Taxmann’s Law Relating to Foreign Contributions (Edition 2026) provides a comprehensive and practical analysis of the Foreign Contribution (Regulation) Act (FCRA), 2010 along with the latest amendments, rules, and compliance requirements. Designed for NGOs, auditors, legal professionals, and policymakers, this book explains registration, utilization, reporting obligations, audit norms, restrictions on foreign funding, and penalties in a clear and structured manner. Updated for 2026, it serves as an essential compliance guide for organizations dealing with foreign contributions.

Taxmann’s Law Relating to Foreign Contributions – Edition 2026 is an authoritative and updated guide to understanding and complying with the Foreign Contribution (Regulation) Act (FCRA), 2010 and the corresponding rules, notifications, and amendments.

This book provides a detailed and practical explanation of the legal framework governing the acceptance and utilization of foreign contributions in India. It covers essential topics such as FCRA registration, prior permission, bank account requirements, utilization norms, donation restrictions, compliance obligations, record maintenance, audit requirements, and annual return filing through Form FC-4. The book also elaborates on recent policy changes affecting NGOs, educational institutions, charitable bodies, and social welfare organizations.

With numerous case studies, clarifications, and practical examples, the book simplifies complex provisions related to suspension or cancellation of registration, inspection powers, offences, penalties, and compounding procedures. It also provides insights into the obligations of key functionaries, governance standards, and best practices to help organizations remain fully compliant with the law.

Written by Taxmann, India’s leading publisher for legal and regulatory literature, this 2026 edition incorporates the latest amendments, circulars, compliance timelines, and updated regulatory expectations. It is an indispensable resource for NGOs, compliance officers, auditors, consultants, researchers, and policymakers dealing with foreign funding.

Whether you are setting up an NGO, managing compliance, or advising clients, this book serves as a reliable, structured, and up-to-date reference for navigating the complexities of foreign contribution regulations in India.