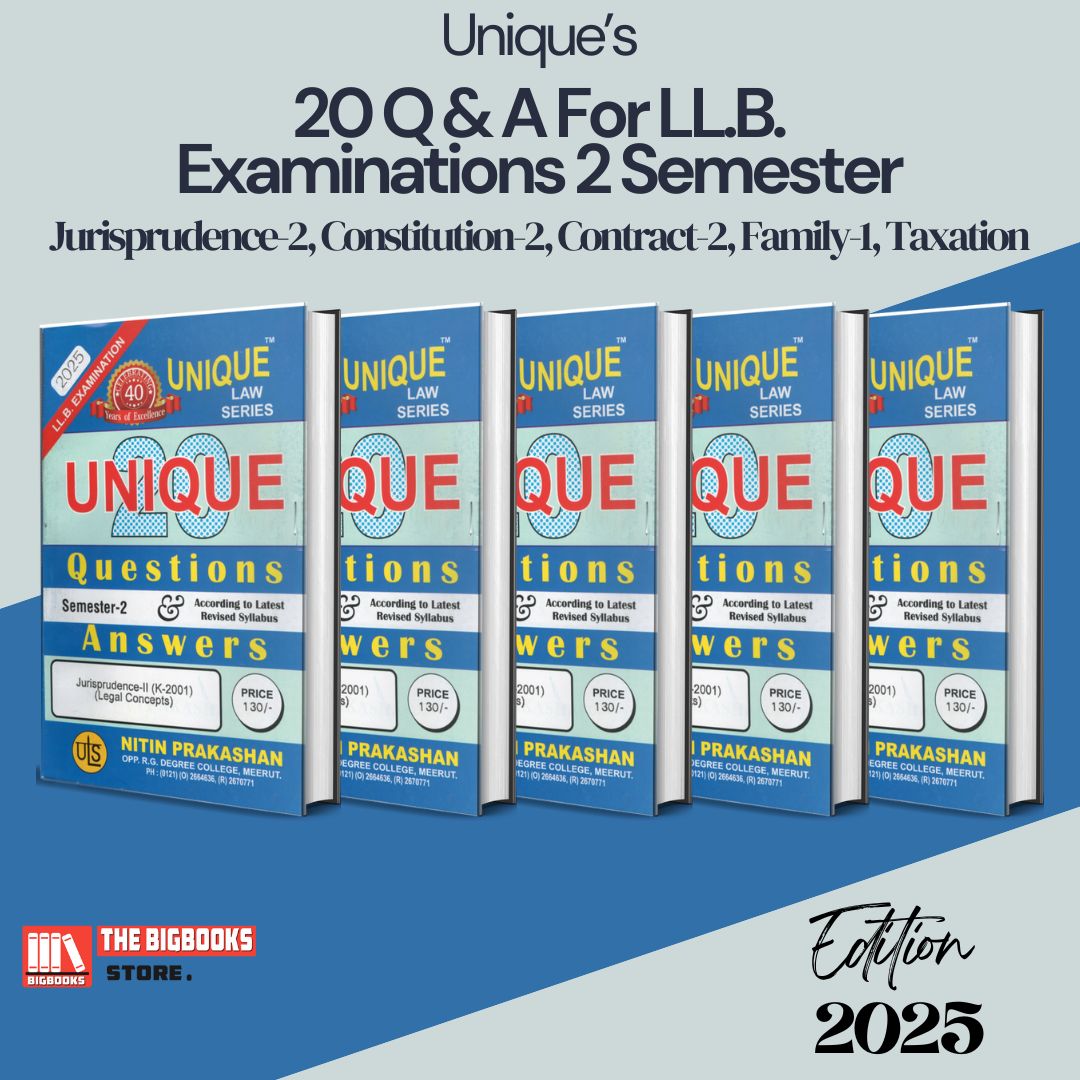

Unique’s, 20 Q & A For LL.B. Examinations 2 Semester (Jurisprudence-2, Constitution-2, Contract-2, Family-1, Taxation) – Edition 2025

| Author : | Unique |

|---|

This 2025 edition of LexisNexis' "Unique's 20 Q&A" provides targeted preparation for 2nd semester LL.B. exams. Covering Jurisprudence-2, Constitution-2, Contract-2, Family-1, and Taxation, it offers concise question-and-answer formats, aiding students in efficiently grasping key legal concepts and exam-relevant topics.

Share this product

Unique’s 20 Q & A For LL.B. Examinations 2 Semester (Jurisprudence-2, Constitution-2, Contract-2, Family-1, Taxation) – Edition 2025

This comprehensive study guide, "Unique’s 20 Q & A For LL.B. Examinations 2 Semester," is meticulously crafted to equip law students with the essential knowledge and understanding required to excel in their second-semester examinations. Covering pivotal subjects like Jurisprudence-2, Constitution-2, Contract-2, Family-1, and Taxation, this edition for 2025 offers a focused and effective approach to mastering complex legal concepts.

Intended Audience:

- LL.B. Students: Specifically designed for students preparing for their second-semester examinations, this guide offers targeted study material.

- Law Aspirants: Individuals seeking a concise yet thorough overview of key legal principles will find this book invaluable.

- Review and Revision: Students needing a quick and effective revision tool before exams will benefit from the Q&A format.

Key Features:

- Focused Question & Answer Format: Presents 20 crucial questions and detailed answers for each subject, facilitating quick and efficient learning.

- Comprehensive Subject Coverage: Spans across Jurisprudence-2, Constitution-2, Contract-2, Family-1, and Taxation, ensuring a holistic understanding of the syllabus.

- Up-to-Date Content: The 2025 edition incorporates the latest legal developments and case laws, ensuring relevance and accuracy.

- Simplified Explanations: Complex legal concepts are broken down into easy-to-understand language, making learning accessible.

- Exam-Oriented Approach: The questions are carefully selected based on their relevance and frequency in past examinations, maximizing preparation efficiency.

- Practical Examples and Case Laws: Relevant case laws and practical examples are integrated into the answers, enhancing comprehension and application.

- Structured Learning: Organized by subject, the book allows students to focus on specific areas or gain a comprehensive overview of the entire syllabus.

Coverage:

- Jurisprudence-2: Explores advanced concepts in legal theory, including different schools of thought and contemporary legal issues.

- Constitution-2: Covers fundamental rights, directive principles, the judiciary, and other crucial aspects of the Indian Constitution.

- Contract-2: Delves into specific contracts, including indemnity, guarantee, bailment, pledge, and agency, with a focus on practical applications.

- Family-1: Addresses key aspects of family law, including marriage, divorce, maintenance, and inheritance, with a focus on personal laws.

- Taxation: Provides an overview of fundamental taxation principles, including income tax, GST, and other relevant tax laws.

Structure:

- Subject-Specific Chapters: Each subject is presented in a dedicated chapter, allowing for focused study.

- 20 Q&A Per Subject: Each chapter contains 20 carefully curated questions and detailed answers.

- Clear and Concise Language: The content is presented in a clear and concise manner, facilitating easy comprehension.

- Relevant Case Laws and Examples: Each answer is supported by relevant case laws and practical examples, enhancing understanding and retention.

- Updated for 2025: The content is updated to reflect the latest legal developments and exam patterns.