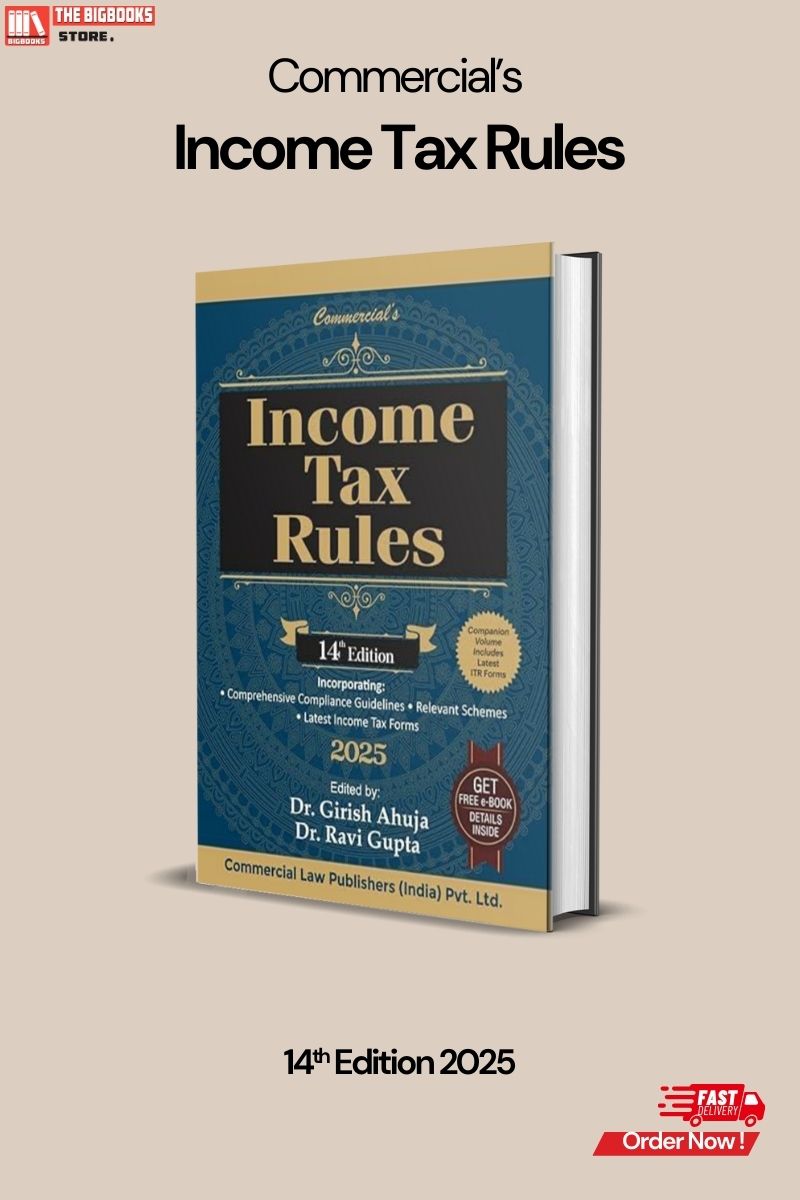

Commercial's Income Tax Rules- 14th Edition 2025

| Author : | COMMERCIAL`S |

|---|

1500

English

14th Edition 2025

Tags: Direct Tax Law Manual, Income Tax, Direct Taxes Ready Reckoner, Income Tax, New Finance Act, 2025-2026, Budget Edition 2025, Income Tax Bill, Income Tax Rules

Commercial's Income Tax Rules

This publication, often authored by Dr. Girish Ahuja and Dr. Ravi Gupta, is a key resource for understanding the intricacies of the Income Tax Rules in India. It's designed to provide comprehensive and up-to-date information for tax professionals, accountants, and anyone dealing with Indian income tax compliance.

Key Features of the Book:

- Comprehensive Coverage:

- Provides detailed information on the Income Tax Rules and related allied rules and schemes.

- Includes the latest Income Tax forms.

- Aids in understanding the practical application of the rules.

- Up-to-Date Information:

- Regularly updated to reflect changes in tax laws and regulations.

- Incorporates amendments and notifications from relevant authorities.

- Practical Guidance:

- Offers practical insights and compliance guidelines.

- Serves as a valuable tool for ensuring adherence to tax regulations.

- Authoritative Authors:

- Authored by respected experts in the field of taxation, Dr. Girish Ahuja and Dr. Ravi Gupta, ensuring accuracy and reliability.

- Modern Accessibility:

- Many of the newer versions of this publication, now include access to E-books, and downloadable ITR forms.

Why This Book is Essential?

- Compliance: Helps individuals and businesses stay compliant with Indian income tax laws.

- Accuracy: Provides accurate and reliable information from respected authors.

- Practicality: Offers practical guidance for real-world tax scenarios.

- Up to date: Supplies the most recent changes to income tax law.

This publication is a valuable tool for anyone needing to navigate the complexities of Indian income tax rules.

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)