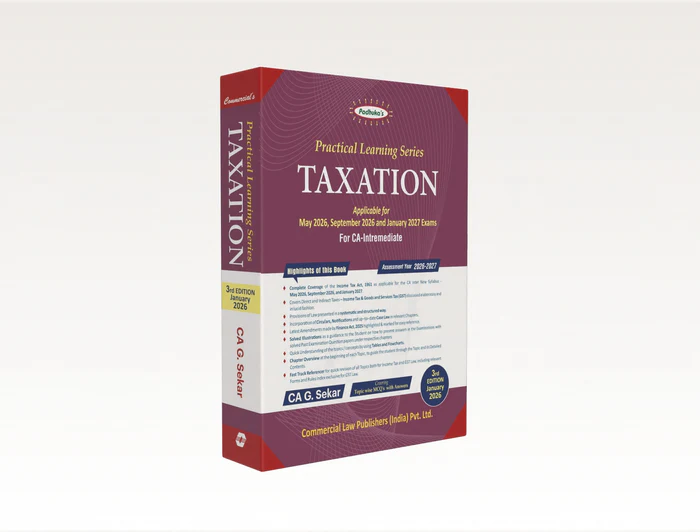

Commercial's Padhuka's Practical Learning Series — Taxation including MCQ's (CA Inter) - 3rd Edition 2026

| Author : | CA G. SEKAR |

|---|

Commercial’s Practical Learning Series — Taxation (Including MCQs) for CA Inter – 3rd Edition 2026 is a comprehensive and exam-oriented guide designed strictly as per the latest ICAI syllabus. This book provides clear conceptual explanations of Direct Tax (Income Tax) and Indirect Tax (GST), supported by practical illustrations, problem-based learning, and a wide range of multiple-choice questions (MCQs).

The content is structured to enhance conceptual clarity, practical application, and exam readiness, making it an ideal resource for CA Intermediate students preparing for both theory and MCQ-based assessment

Commercial’s Practical Learning Series — Taxation (Including MCQs) for CA Intermediate – 3rd Edition 2026 is a comprehensive, exam-focused, and concept-driven study companion developed strictly in accordance with the latest ICAI syllabus and examination pattern. This book is specially curated to help CA Intermediate students build strong conceptual clarity in Direct Taxation (Income Tax) and Indirect Taxation (Goods and Services Tax – GST) while also preparing effectively for MCQ-based assessments and descriptive questions.

The book follows a practical learning approach, ensuring that students not only understand the provisions of tax laws but also learn how to apply them accurately in problem-solving scenarios—an essential skill for success in CA examinations.

Extensive Coverage of CA Inter Taxation Syllabus

This edition offers detailed and structured coverage of:

-

Income Tax Law: Basic concepts, residential status, heads of income, deductions, exemptions, computation of total income, and tax liability

-

Goods and Services Tax (GST): Supply, levy, time and place of supply, input tax credit, registration, returns, payment, and compliance procedures

Each topic is explained in a student-friendly and logical manner, supported by illustrations, numerical examples, and practical case-based questions aligned with ICAI expectations.

MCQ-Focused Learning for Exam Readiness

Recognizing the importance of objective-type questions in CA examinations, this book includes:

-

Chapter-wise MCQs covering both Income Tax and GST

-

Questions framed as per ICAI exam standards

-

MCQs designed to test conceptual understanding, application, and analytical ability

These MCQs help students strengthen accuracy, speed, and confidence during exams.

Practical Learning & Application-Oriented Approach

The hallmark of this series is its practice-oriented presentation, which enables students to:

-

Understand complex tax provisions through step-by-step illustrations

-

Apply law to practical scenarios commonly asked in exams

-

Avoid common mistakes in computation and interpretation

This approach makes the book suitable for self-study as well as classroom reference.

Who Should Use This Book

This book is ideal for:

-

CA Intermediate students preparing for Taxation

-

Students appearing under the new ICAI syllabus

-

Faculty members and coaching institutes

-

Students seeking strong conceptual grounding with ample MCQ practice

Key Features

-

Fully updated as per latest amendments applicable for 2026 exams

-

Covers Income Tax and GST comprehensively

-

Includes chapter-wise MCQs and practical illustrations

-

Simple language with exam-oriented explanations

-

Trusted content from Commercial Law Publishers

Commercial’s Practical Learning Series — Taxation (Including MCQs) (CA Inter) – 3rd Edition 2026 is a reliable and result-oriented resource that bridges the gap between theory and practical application. It equips CA Intermediate students with the knowledge, practice, and confidence required to excel in taxation papers and achieve success in the CA journey.