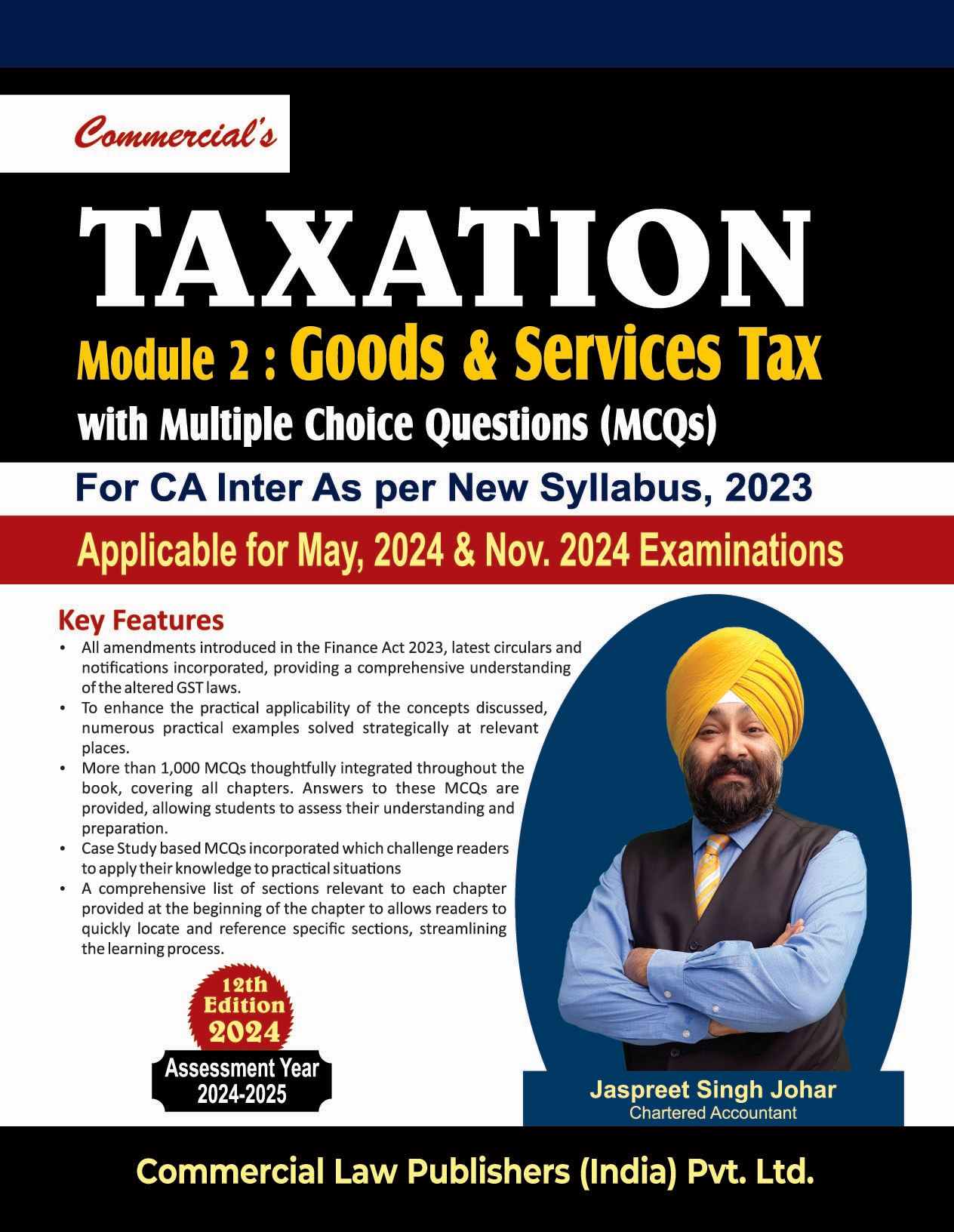

Commercial's Taxation Model 2 : Goods & Services Tax (GST) with (MCQs) - 12th Edition 2024

| Author : | COMMERCIAL`S, Jaspreet singh johar |

|---|

Commercial’s Taxation Model 2: Goods & Services Tax (GST) with MCQs – 12th Edition 2024 is a comprehensive and exam-oriented guide covering the principles, provisions, and practical aspects of India’s Goods and Services Tax regime. The book presents GST concepts in a clear and structured manner, supported by multiple-choice questions to aid learning and assessment.

This updated 12th edition reflects the latest GST laws, amendments, and procedural changes, making it ideal for students, professionals, and aspirants preparing for commerce, taxation, and competitive examinations. The inclusion of MCQs helps reinforce understanding and enables effective self-evaluation

Commercial’s Taxation Model 2: Goods & Services Tax (GST) with MCQs – 12th Edition 2024 is a comprehensive, exam-oriented and practice-focused guide designed to provide a thorough understanding of India’s Goods and Services Tax (GST) framework. Published by Commercial Law Publishers (India), this trusted title has been widely used by students and professionals for mastering GST law, concepts, and practical application.

This 12th Edition 2024 is fully updated in line with the latest GST amendments, notifications, and procedural developments, ensuring that readers work with current and accurate information. The book adopts a systematic and student-friendly approach, explaining GST provisions in a clear, structured manner supported by illustrations, examples, and practical explanations.

Comprehensive Coverage of GST Law

The book covers all major components of GST, including:

-

Constitutional background and evolution of GST

-

Levy and collection of GST

-

Supply of goods and services

-

Time, place, and value of supply

-

Input Tax Credit (ITC)

-

Registration and returns

-

Tax invoice, payment of tax, and refunds

-

Assessment, audit, inspection, search, seizure, and arrest

-

Offences, penalties, and prosecution

-

Appeals, revisions, and advance rulings

Each topic is arranged logically, making it easy for readers to understand the flow of GST law and its practical implications.

MCQ-Based Learning for Exam Success

A key strength of this book is the extensive inclusion of Multiple Choice Questions (MCQs) at the end of relevant chapters. These MCQs are carefully framed to:

-

Test conceptual clarity

-

Improve accuracy and speed

-

Familiarise students with exam patterns

-

Enable effective self-assessment and revision

This makes the book particularly valuable for commerce, taxation, and professional course examinations.

Ideal for Students and Professionals

The book is highly useful for:

-

B.Com, M.Com, and commerce students

-

CA, CS, CMA, and other professional course aspirants

-

GST practitioners and tax consultants

-

Faculty members and trainers

-

Candidates preparing for competitive and entrance examinations involving GST

Updated, Reliable & Practice-Oriented

With its clear language, structured presentation, updated legal position, and exam-focused MCQs, this book serves both as a learning textbook and a practical revision tool. It helps readers build strong conceptual foundations while also developing the confidence to tackle objective-type questions effectively.

Conclusion

Commercial’s Taxation Model 2: Goods & Services Tax (GST) with MCQs – 12th Edition 2024 is an essential resource for anyone seeking a clear, updated, and exam-ready understanding of GST law in India. Its balanced mix of theory and practice makes it a must-have title for students and professionals aiming for excellence in GST and indirect taxation.