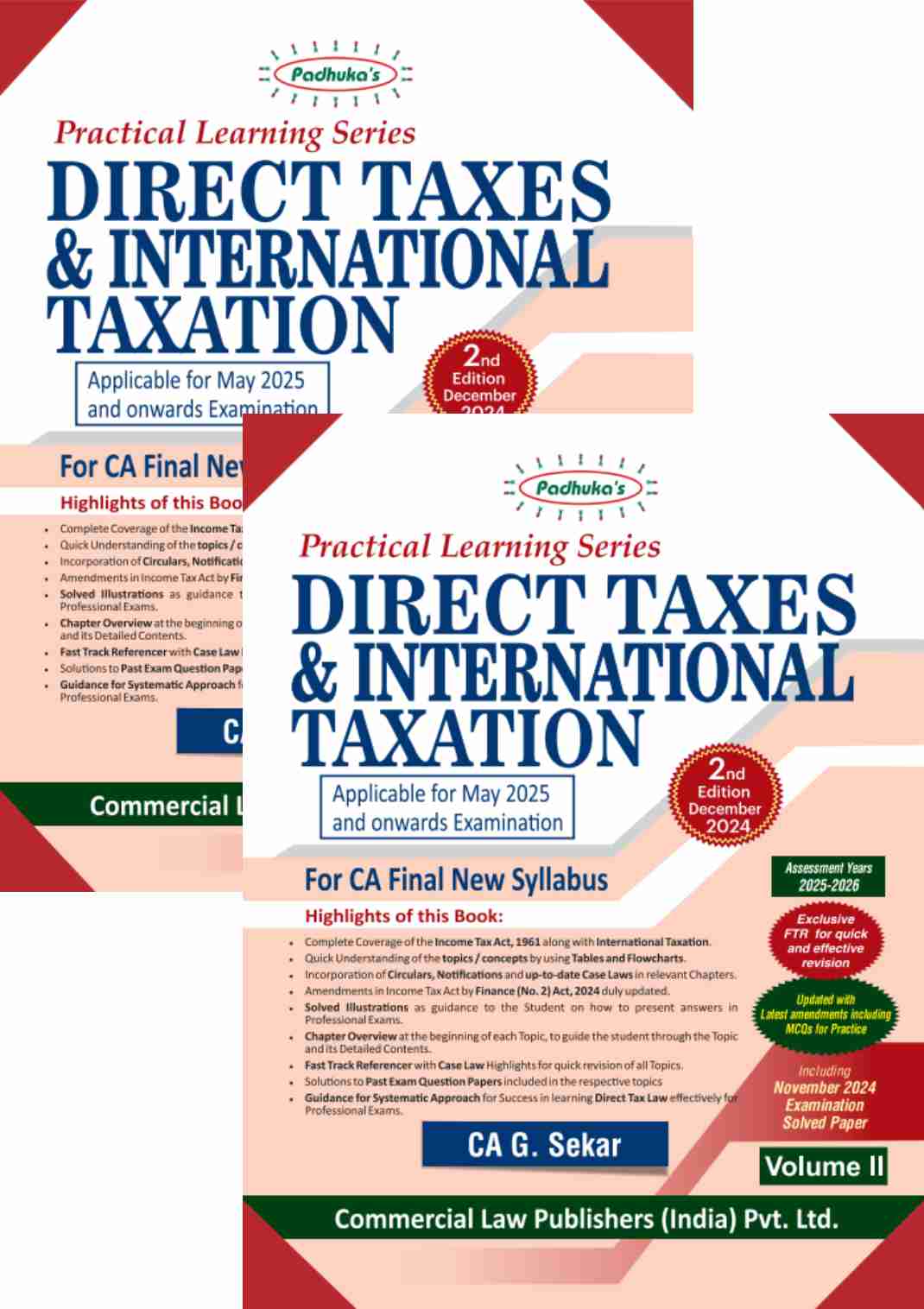

Commercial's Practical Learning Series Direct Taxes and International Taxation (Set of 2 Vols.) For CA Final - Edition 2025

| Author : | CA G. SEKAR |

|---|

1799

English

2025

Commercial's Practical Learning Series – Direct Taxes and International Taxation (Set of 2 Volumes) for CA Final

Commercial's Practical Learning Series – Direct Taxes and International Taxation – Edition 2025 is a comprehensive two-volume set designed exclusively for students appearing for the CA Final Examination under the New Scheme of ICAI. This latest edition provides an in-depth, conceptual, and analytical treatment of both domestic tax laws and international taxation provisions, completely aligned with the Finance Act, 2025 and recent updates by the CBDT and ICAI.

Curated by experienced authors and subject experts, this book is tailored to meet the dual objective of conceptual clarity and exam readiness. With detailed coverage of Income Tax Act provisions, case laws, DTAA concepts, and BEPS guidelines, this guide ensures that learners master every aspect of Direct Tax & International Taxation with a problem-solving approach.

Key Features:

-

📘 Two-Volume Comprehensive Coverage:

Volume I focuses on core Direct Tax provisions under the Income Tax Act, 1961, while Volume II is dedicated to International Taxation, covering cross-border taxation, DTAA, transfer pricing, and recent OECD developments. -

📅 Amended as per Finance Act, 2025:

Fully updated with relevant changes, including updated tax slabs, surcharge, rebate, and compliance timelines, applicable for Sept 2025 & Jan 2026 exam cycles. -

🔍 In-depth Coverage of Important Topics:

Includes capital gains, income from business/profession, set-off and carry forward of losses, MAT/AMT, and TDS/TCS, along with extensive treatment of GAAR, Equalisation Levy, Significant Economic Presence, and Tax treaties. -

⚖️ Inclusion of Landmark Case Laws & CBDT Circulars:

Equipped with recent judicial pronouncements, circulars, and notifications with summaries to ensure legal relevance in your answers. -

🧾 Exam-Oriented Presentation:

Provides step-by-step answers, illustrations, flowcharts, and summary tables modeled in the ICAI exam format. -

📚 Practice Material for Exam Prep:

Integrates past exam questions, RTPs, MTPs, and ICAI-issued case scenarios with author-guided solutions to ensure full exam coverage. -

📈 Special Focus on International Taxation:

Comprehensive explanation of transfer pricing methodologies, DTAA application, Base Erosion and Profit Shifting (BEPS), and OECD framework to equip aspirants with a global tax perspective. -

✍️ Conceptual Clarity + Practical Utility:

Real-world examples and practical problem sets help bridge the gap between academic understanding and real tax practice.

Why You Must Have This Book:

✅ One-Stop Solution for CA Final (New Scheme): Covers the entire syllabus for Direct Taxes and International Taxation, including recent tax reforms and emerging global tax practices.

✅ Dual Benefit of Learning + Scoring: Aids in both deep learning and efficient scoring through structured content and targeted practice questions.

✅ Designed for Self-Study: Student-friendly layout, language, and examples make this set ideal for self-learners as well as classroom preparation.

✅ Applicable for Practitioners Too: A useful reference for young CAs, tax professionals, and consultants dealing with cross-border taxation issues.

✅ Trusted by Toppers & Teachers: A go-to publication across CA coaching institutes for mastering the toughest paper in CA Final.