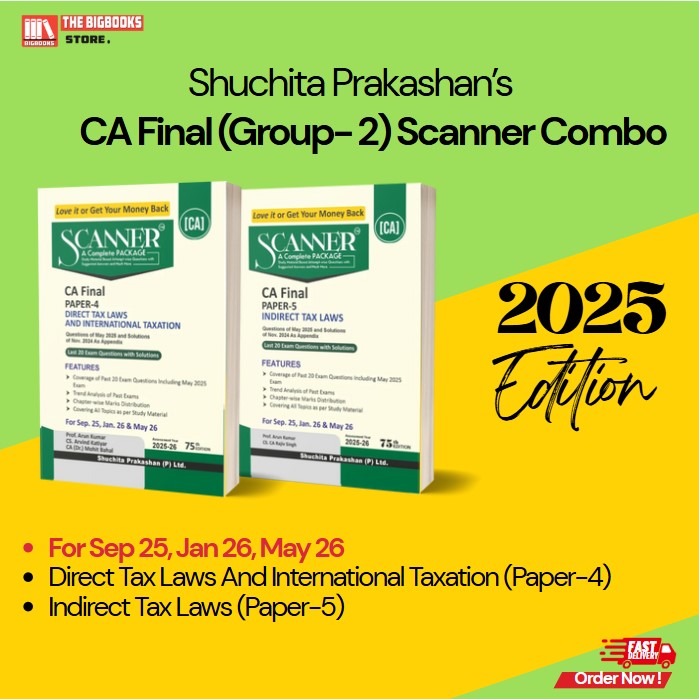

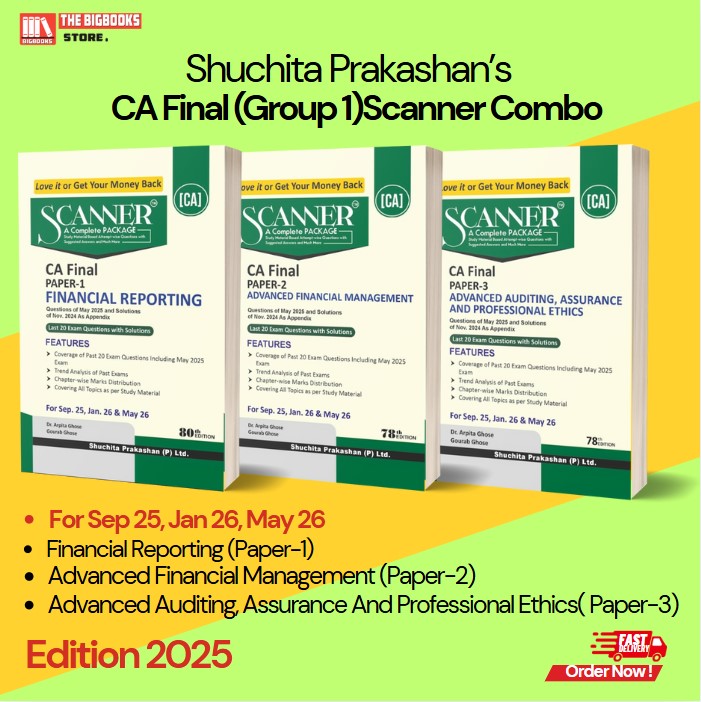

Shuchita Prakashan’s CA Final Scanner Combo (Group 2) Direct Tax Laws and International Taxation (Paper-4), Indirect Tax Laws (Paper-5), For Sep 25, Jan 26, May 26 - Edition 2025

| Author : | CA Arun Kumar Gupta, Arvind Kumar Gupta |

|---|

Shuchita Prakashan’s CA Final Scanner Combo (Group 2) – 2025 Edition features solved past papers for Paper 4: Direct Tax Laws & International Taxation and Paper 5: Indirect Tax Laws, tailored for ICAI attempts in Sep 2025, Jan 2026 & May 2026.

Shuchita Prakashan’s CA Final Scanner Combo (Group 2) – Direct Tax Laws & International Taxation (Paper-4), Indirect Tax Laws (Paper-5)

Shuchita Prakashan’s CA Final Group 2 Scanner Combo – Edition 2025 is a focused and exam-ready resource tailored for students preparing for the CA Final examinations under the new ICAI scheme. This combo covers Paper 4: Direct Tax Laws & International Taxation (DT) and Paper 5: Indirect Tax Laws (IDT), with full updates as per the latest Finance Act, circulars, and GST notifications applicable for September 2025, January 2026, and May 2026 exam attempts.

This combo is structured to offer topic-wise solved past exam questions, RTPs, MTPs, and ICAI Suggested Answers, all arranged systematically to promote clarity, conceptual understanding, and practice-based learning. It is a complete revision and practice package for CA aspirants aiming to score high in both DT and IDT papers.

Key Features:

-

✅ Covers ICAI's Latest Syllabus:

Fully updated as per the revised scheme of CA Final Group 2 for upcoming attempts in Sep 2025, Jan 2026 & May 2026. -

📑 Paper-Wise and Chapter-Wise Question Segregation:

Past exam questions, case studies, and theory questions are categorized chapter-wise with model solutions. -

💼 Paper 4 – Direct Tax Laws & International Taxation:

Includes coverage of income-tax provisions, transfer pricing, GAAR, DTAA, equalization levy, and case law-based questions. -

💸 Paper 5 – Indirect Tax Laws:

Focuses on GST, Customs, and FTP topics, with practical illustrations, compliance scenarios, and recent amendments. -

📊 MTPs, RTPs, and ICAI Suggested Answers Included:

Ensures complete exam orientation and practice with real exam-style questions. -

🧠 Effective Answer Writing Techniques:

Offers guidance on drafting answers as per ICAI standards for case-study-based and numerical questions.

Why This Book is Essential:

-

🔍 Perfect for Exam-Oriented Preparation:

Helps students understand paper patterns, mark allocation, and recurring question trends from previous ICAI exams. -

🎯 Ideal for Last-Minute and In-Depth Revision:

Helps aspirants consolidate their understanding with structured practice right before the exam. -

📖 Trusted Resource for Self-Study & Coaching Students:

An essential tool for both classroom learners and self-study candidates due to its step-by-step explanation format. -

📚 Conceptual Clarity + Practical Insight:

Supports learning of complex taxation topics by combining theory, law, application, and case laws. -

⏱️ Boosts Speed and Accuracy:

Regular practice with this scanner helps in improving speed, precision, and confidence in the exam hall.