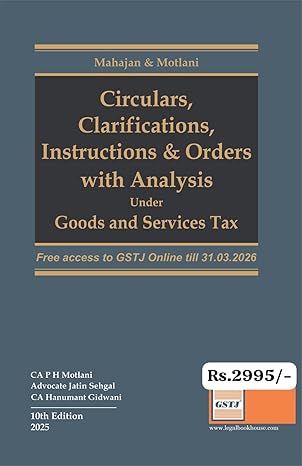

GSTJ'S Circulars, Clarifications, Instructions & Order with Analysis Under GST Goods and Service Tax - 10th Edition 2025

| Author : | C.A. P. H. Motlani, Advocate Jatin Sehgal |

|---|

GSTJ'S Circulars, Clarifications, Instructions & Order with Analysis Under GST (Goods and Services Tax)

GSTJ’S Circulars, Clarifications, Instructions & Order with Analysis Under GST – 10th Edition 2025 is a detailed and updated compendium that offers a deep dive into the administrative and interpretative aspects of the Goods and Services Tax (GST) regime in India. This authoritative guide compiles all major circulars, clarifications, instructions, and orders issued by CBIC and relevant authorities, along with in-depth commentary and analysis to help professionals understand and apply GST laws with clarity.

This latest edition is fully updated as per the Finance Act, 2025 and includes insights into newly issued notifications and judicial decisions impacting the interpretation of GST provisions. Structured for easy reference and practical utility, the book bridges the gap between statutory provisions and their administrative implementation, making it an essential resource for tax professionals, consultants, practitioners, corporate finance teams, and students.

Key Features:

-

📜 Complete Compilation of Circulars & Instructions: Covers all significant circulars, clarifications, and instructions issued under GST law, including those impacting registration, input tax credit, export-import transactions, returns, audits, refunds, and assessments.

-

🧾 Authoritative Analysis: Each document is followed by expert commentary, practical illustrations, and cross-references to applicable GST provisions, rules, and forms.

-

📅 Updated Till Finance Act 2025: Incorporates the latest legal changes, administrative updates, and procedural amendments to reflect current GST practices.

-

🔍 Topic-Wise Presentation: Structured for ease of use, enabling users to search for relevant updates under specific GST topics and sections.

-

⚖️ Includes Judicial Pronouncements: Highlights relevant case laws and tribunal rulings to aid interpretation and compliance.

-

👨💼 Daily Use for Professionals: A desk companion for CAs, tax lawyers, GST consultants, and corporate tax departments for answering notices, preparing replies, and advising clients.

-

🧠 Clarity on Complex Issues: Demystifies ambiguous or conflicting positions taken in GST communications with simplified language and actionable interpretation.

Why This Book is Indispensable:

-

✅ Simplifies Compliance: Enables better understanding of the intent behind circulars and instructions, helping users remain compliant with GST regulations.

-

📚 Bridges Law & Practice: Connects statutory GST provisions with real-world application, giving readers a 360-degree view of GST administration.

-

🛠️ A Tool for Every GST Practitioner: Essential for handling departmental communication, legal representation, and accurate tax planning.

-

🎓 Ideal for Professionals & Students: Suitable for CAs, CMAs, CSs, tax professionals, and students preparing for GST-based professional exams.