Taxmann's GST Appeals & Appellate Tribunal - Edition 2026

| Author : | TAXMANN`S |

|---|

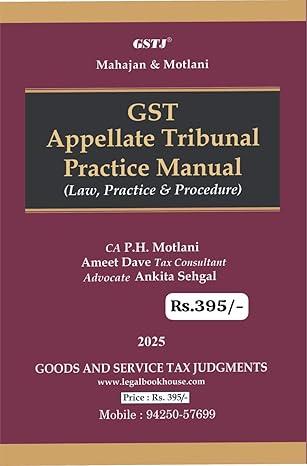

Taxmann's GST Appeals & Appellate Tribunal – Edition 2026 is a specialized and updated guide focusing on the appellate and dispute resolution framework under the Goods and Services Tax regime in India. This edition covers statutory provisions, procedural rules, appellate authorities, and the functioning of the GST Appellate Tribunal, along with relevant case laws and practical guidance.

Designed for tax professionals, advocates, chartered accountants, company secretaries, consultants, and students, the book provides clear insights into filing appeals, procedural compliance, and effective representation before GST appellate forums.

Taxmann's GST Appeals & Appellate Tribunal – Edition 2026 is a comprehensive and practice-oriented guide dedicated to the appellate and dispute resolution mechanism under India’s Goods and Services Tax (GST) regime. This authoritative publication is designed to assist advocates, chartered accountants, tax consultants, company secretaries, departmental officers, academicians, and students in navigating the complex appellate procedures under GST law.

The book provides detailed coverage of the statutory framework governing GST appeals, including provisions relating to first appeals, second appeals, revisionary powers, rectification, and the constitution and functioning of the GST Appellate Tribunal. It explains jurisdiction, powers, procedural requirements, limitation periods, pre-deposit norms, and documentation involved at each appellate stage.

The Edition 2026 incorporates the latest amendments, rules, notifications, circulars, and judicial developments relevant to GST litigation. It also reflects recent High Court and Supreme Court judgments that have shaped appellate jurisprudence, providing readers with clarity on evolving legal interpretations and compliance standards.

Special emphasis is placed on practical aspects of filing and arguing GST appeals, including drafting grounds of appeal, preparation of appeal papers, representation before appellate authorities, and compliance with procedural formalities. The book also discusses issues such as stay of recovery, condonation of delay, rectification of errors, and remand proceedings.

Written in a clear, structured, and practitioner-friendly manner, this publication serves both as a ready reference and a procedural manual for handling GST disputes effectively. Whether used for professional practice, academic study, or litigation support, Taxmann's GST Appeals & Appellate Tribunal – Edition 2026 is an indispensable resource for mastering GST appellate law and procedure in India.