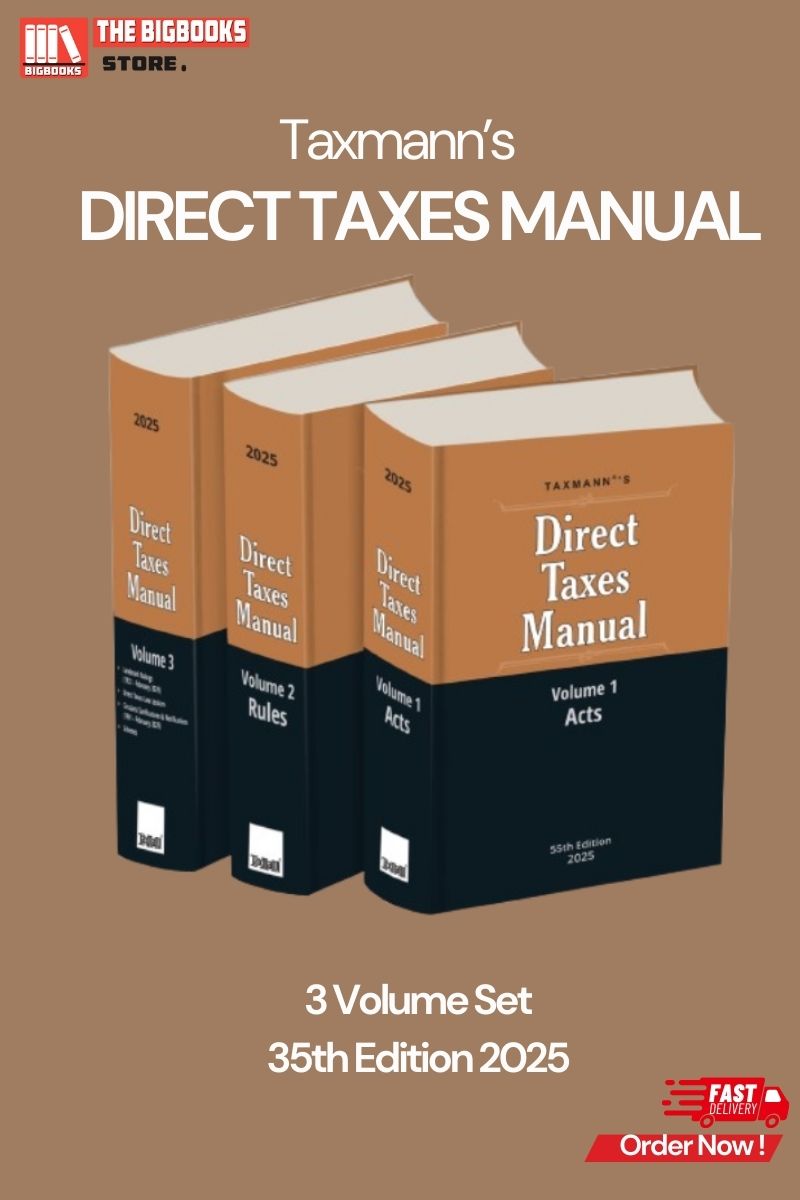

Taxmann's Direct Taxes Manual ( Set of 3Vols ) -35th Edition 2025

| Author : | TAXMANN`S |

|---|

Tags: Direct Tax Law Manual, Income Tax, Direct Taxes Ready Reckoner, Income Tax, New Finance Act, 2025-2026, Budget Edition 2025, Income Tax Bill, Income Tax Rules

Taxmann Direct Taxes Manual

The Taxmann Direct Taxes Manual is a highly regarded, comprehensive, and authoritative three-volume reference set covering the intricacies of Indian direct tax laws. This manual is an essential resource for tax professionals, legal experts, and government officers, providing detailed and accurate information on the Income-tax Act, related legislation, and judicial rulings.

Key Features of the Book:

-

Exhaustive Coverage of Direct Tax Laws:

- Provides a thorough and up-to-date analysis of the Income-tax Act, 1961, and other allied acts.

- Incorporates all amendments introduced by the latest Finance Acts, ensuring accuracy and relevance.

- Covers key aspects of direct taxation, including income tax rules, regulations, and forms.

-

Comprehensive Three-Volume Set:

- Volume I: Focuses on the Acts, providing detailed section-wise analysis.

- Volume II: Covers Rules and Forms, including income tax return forms for the relevant assessment year.

- Volume III: Contains Landmark Rulings and Reference Materials, including a digest of key judicial decisions.

- This organized structure allows for easy navigation and quick access to specific information.

-

Detailed Annotations and References:

- Provides annotations under each section, including relevant rules, forms, circulars, and notifications.

- Includes cross-references to related sections, rules, and rulings, ensuring a comprehensive understanding.

- Contains summaries of landmark rulings that have shaped Direct Tax jurisprudence.

-

Practical Utility and Legal Guidance:

- Includes a Direct Taxes Law Lexicon, providing definitions of key terms and phrases.

- Contains circulars and notifications from relevant authorities.

- Includes return forms, and information supporting the filling of those forms.

- Serves as a vital tool for tax professionals, lawyers, and anyone involved in direct tax compliance.

-

Up-to-Date and Authoritative:

- Regularly updated to reflect the latest legislative changes and judicial pronouncements.

- Compiled by Taxmann's Editorial Board, ensuring accuracy and reliability.

- Trusted by professionals for its comprehensive coverage and meticulous attention to detail.

Why This Book is Essential?

- Comprehensive Resource: Provides a one-stop solution for all direct tax-related information.

- Accurate and Reliable: Compiled by experts and regularly updated to reflect the latest changes.

- Practical Guidance: Offers practical insights and tools for effective tax compliance.

- Legal Authority: Serves as an authoritative reference for legal professionals and tax practitioners.

Order now from Taxmann or other leading book retailers to ensure you have the most up to date, and accurate direct tax information.

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)