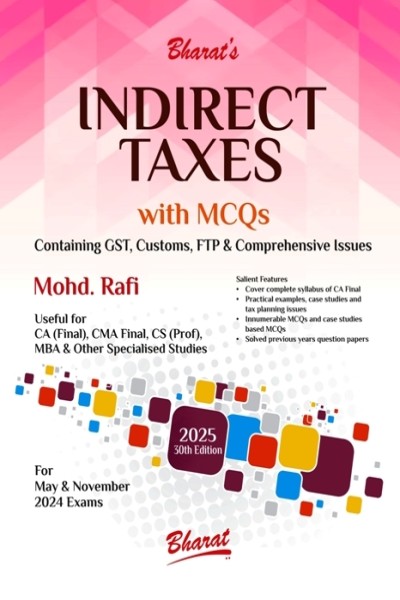

Bharat's Indirect Taxes With MCQ - 30th edition 2025

| Author : | BHARAT`S |

|---|

490

English

30th edition 2025

Tags: CA, • CA FINAL, CS, CMA, • CMA Inter, Indirect Tax Laws

Bharat's Indirect Taxes with MCQ

Bharat's Indirect Taxes with MCQ – 30th Edition 2025 is a thoroughly updated and exam-focused book that offers a comprehensive understanding of Indirect Tax Laws in India. This landmark 30th edition is carefully crafted to cover the Goods and Services Tax (GST), Customs Law, and other indirect taxation topics in a lucid and practical manner, while incorporating a vast collection of Multiple Choice Questions (MCQs) for assessment, revision, and exam preparation.

This book is ideal for students of CA, CMA, CS, LL.B, and other commerce and professional courses, as well as professionals and academicians who wish to keep up with the latest amendments, notifications, and judicial interpretations under indirect tax law. With conceptual clarity, simplified explanations, and exam-oriented presentation, it helps readers not only understand the laws but also apply them accurately.

Key Features:

-

📘 Comprehensive Coverage of Indirect Tax Laws: Includes detailed chapters on GST, Customs Act, FTP (Foreign Trade Policy), and other allied laws, structured in a student-friendly format.

-

🧾 Updated as per Finance Act, 2025: Incorporates all significant legislative changes, circulars, and notifications up to the Finance Act, 2025, ensuring full legal accuracy.

-

📝 Extensive MCQs with Solutions: Features a rich bank of multiple choice questions, including concept-based, application-based, and past exam MCQs, along with answers and explanations for enhanced practice.

-

📚 Conceptual and Practical Balance: Focuses on both theoretical understanding and practical application, helping learners apply tax laws to real-world scenarios with ease.

-

📊 User-Friendly Layout: Presented in a well-structured format with bullet points, flowcharts, and summary tables that aid quick learning and last-minute revision.

-

🧠 Exam-Focused Content: Ideal for self-assessment, mock tests, and quick recaps to boost exam confidence and identify weak areas.

Why This Book is Essential:

-

✅ Best-Seller in Indirect Tax Category: Trusted by generations of students and practitioners, now in its 30th milestone edition.

-

✅ Useful for Multiple Exams: Suitable for CA (Inter and Final), CMA, CS, B.Com, LL.B, and other competitive exams involving indirect tax syllabus.

-

✅ Builds Conceptual Foundation: Provides a clear explanation of basic to advanced tax provisions, perfect for beginners and advanced learners alike.

-

✅ Enhances Exam Performance: Prepares students to tackle both theory and objective-type questions confidently and accurately.

Bharat's Indirect Taxes with MCQ – 30th Edition 2025 continues to be a benchmark publication in the domain of indirect taxation, offering clarity, compliance, and confidence to learners and professionals alike. Whether you're preparing for exams or seeking professional mastery, this book is your go-to guide.