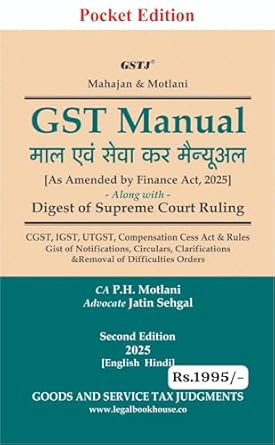

Goods and service Tax Judgment's GST MANUAL - (English + Hindi) Latest - 2nd Edition 2025

| Author : | MAHAJAN & MOTLANI |

|---|

632

Hindi+English

2nd Edition 2025

GST MANUAL (English + Hindi)

Goods and Service Tax Judgment’s GST MANUAL (English + Hindi) – 2nd Edition, 2025 is a bilingual and updated reference manual that brings together the latest provisions, rules, and judicial interpretations under the Goods and Services Tax (GST) law in India. Designed for ease of understanding and practical utility, this manual provides side-by-side English and Hindi text, making it an invaluable tool for taxpayers, practitioners, students, and government officials working in bilingual environments.

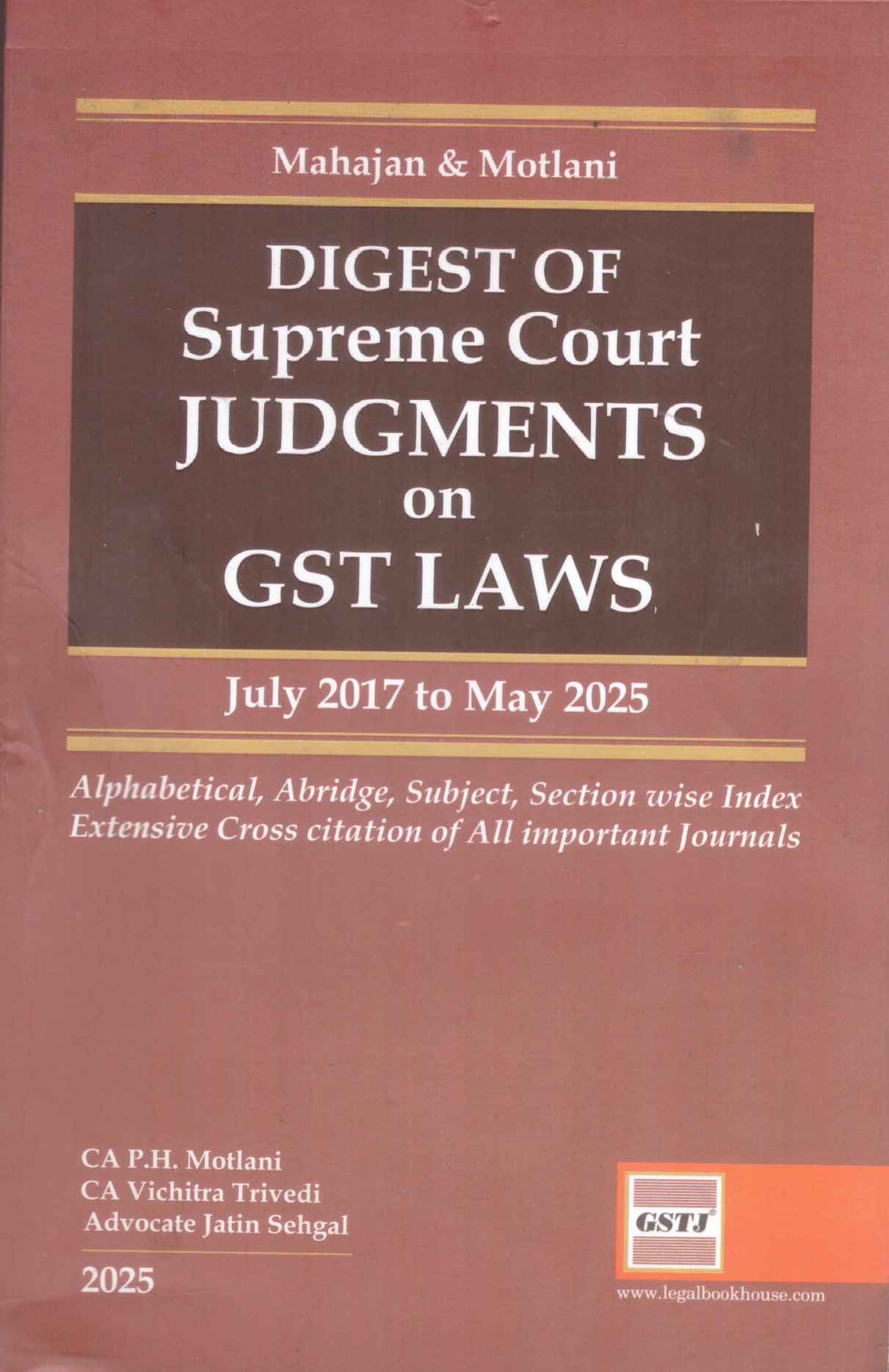

Now in its 2nd Edition, the book is fully updated as per amendments introduced up to the Finance Act, 2025 and latest notifications, circulars, and case laws. It offers a well-structured and easy-to-navigate presentation of the GST Acts, Rules, and Schedules, along with relevant Supreme Court and High Court judgments that have influenced GST interpretation and implementation.

Key Features:

-

Bilingual Format (English + Hindi): Each section of law and corresponding commentary is presented in both English and Hindi, enabling easy understanding and cross-referencing for a wider audience.

-

Covers All Key GST Laws: Includes CGST Act, SGST Acts, IGST Act, UTGST Act, and Compensation to States Act, with integrated rules, forms, and amendments.

-

Updated as per Finance Act 2025: Incorporates all legislative amendments, latest circulars, notifications, and changes applicable as of 2025.

-

Judgment-Based Explanations: Features summarized and cited landmark GST rulings that clarify complex legal provisions and practical issues.

-

User-Friendly Layout: Law sections are followed by headnotes, commentary, and judicial references, making it simple to understand and apply.

-

Ideal for Professionals and Students: Perfect for GST practitioners, tax consultants, legal professionals, students, and departmental officers preparing for audits, litigation, or exams.

-

Quick Reference Aids: Includes indexes, cross-references, and rule-formation guidance to enable efficient lookup and application of GST provisions.

Why This Book is Essential:

-

First-of-Its-Kind Bilingual GST Manual: Fulfills the critical need for a comprehensive dual-language GST reference for professionals and Hindi-speaking users.

-

Helps Understand Judicial Trends: Judgment-based format helps in grasping practical implications of legal interpretations by courts and tribunals.

-

Bridges Law and Practice: Goes beyond the bare text of the law to provide context, commentary, and real-world clarity through landmark rulings.

-

Updated and Reliable Resource: Offers a current and consolidated legal view with all updates till 2025, saving time for busy professionals.

-

Supports Compliance and Litigation Readiness: A must-have for preparing GST returns, assessments, legal representations, and appeals.

Goods and Service Tax Judgment’s GST MANUAL (English + Hindi) – 2nd Edition, 2025 is an indispensable guide for understanding and navigating the ever-evolving GST regime in India. With its bilingual approach and focus on case law, it is a valuable companion for GST professionals, students, and authorities alike.