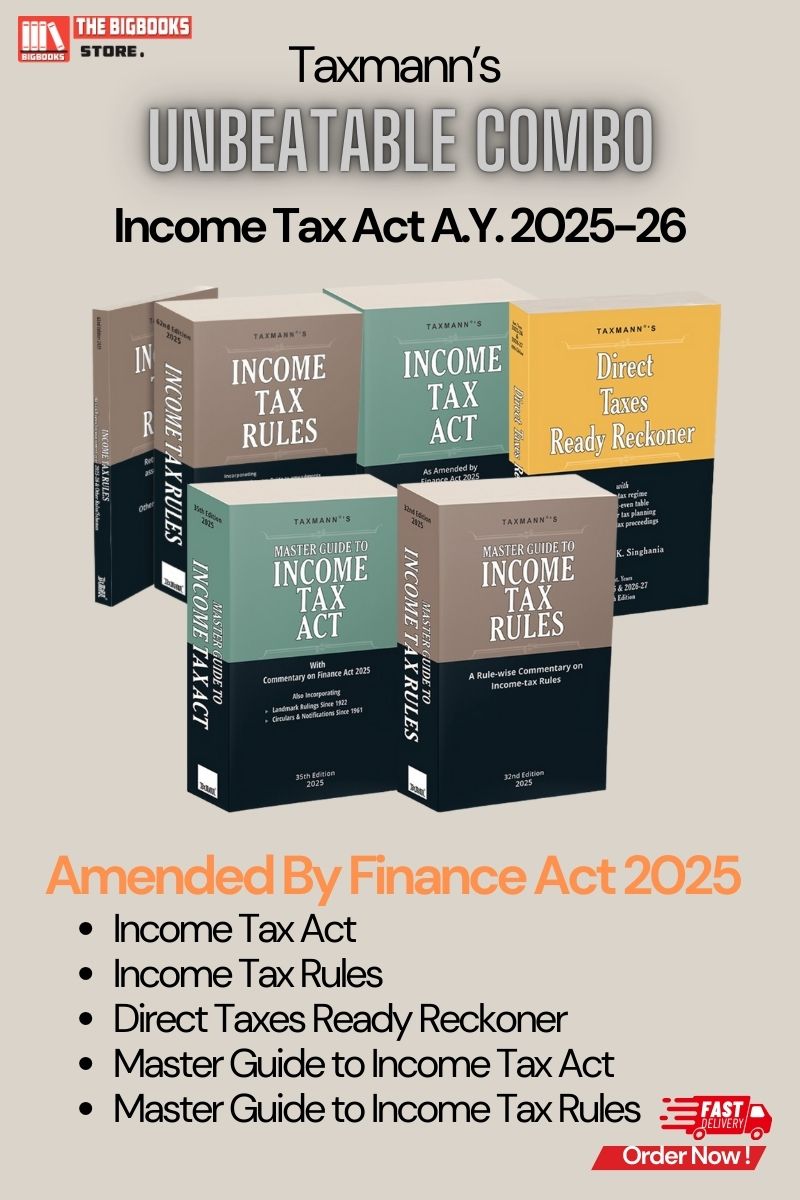

Taxmann COMBO of 5-Income Tax Act A.Y. 2025-26

Income Tax Act A.Y. 2025-26 – UNBEATABLE COMBO

The Income Tax Act A.Y. 2025-26 – UNBEATABLE COMBO is a must-have collection for tax professionals, chartered accountants, lawyers, business owners, and finance students. This comprehensive set includes five essential books that provide an in-depth understanding of India’s direct tax system, including the latest amendments introduced by the Finance Act, 2025. Whether you are a tax consultant, corporate professional, or law practitioner, this expertly curated combo ensures you have everything you need to stay updated on income tax laws, rules, and practical applications.

What’s Included in This Combo?

1. Income Tax Act (Amended by Finance Act, 2025)

• Full text of the Income Tax Act, 1961, updated with amendments from the Finance Act, 2025.

• Section-wise analysis, ensuring clarity on tax provisions and compliance requirements.

• Latest legal interpretations, including Supreme Court and High Court judgments.

• A complete reference tool for professionals and businesses handling tax matters.

2. Income Tax Rules

• Comprehensive coverage of all income tax rules governing compliance, procedures, and regulations.

• Updated with recent changes in tax administration, filing norms, and assessment procedures.

• Essential for professionals dealing with tax audits, appeals, and regulatory compliance.

3. Direct Taxes Ready Reckoner

• A quick reference guide to the latest tax slabs, deductions, exemptions, and TDS rates.

• Comparison tables, worked-out examples, and case laws for easy understanding.

• Ideal for professionals needing a fast and accurate tax reference for planning and advisory.

4. Master Guide to Income Tax Act

• Detailed commentary and interpretation of key provisions of the Income Tax Act.

• Explains complex tax laws in an easy-to-understand manner with practical examples.

• Essential for those preparing for CA, CS, CMA, and tax-related exams, as well as tax practitioners.

5. Master Guide to Income Tax Rules

• Provides a structured and detailed explanation of income tax rules.

• Helps tax professionals and businesses navigate regulatory requirements with confidence.

• Updated to include the latest notifications, clarifications, and amendments.

Why Choose This Combo?

✔ Latest Updates – Fully revised with changes from the Finance Act, 2025, ensuring compliance with new tax laws.

✔ Comprehensive & Practical – Covers the Income Tax Act, Rules, and essential reference guides for professional use.

✔ Essential for Tax Practitioners – A single package for tax consultants, CAs, finance professionals, and business owners.

✔ Exam & Practice Ready – Perfect for students preparing for CA, CS, CMA, and judiciary exams, along with tax professionals handling client cases.

✔ Time-Saving Resource – The Direct Taxes Ready Reckoner provides quick references, reducing the time needed for tax calculations and compliance.

Stay ahead in tax law and compliance with the Income Tax Act A.Y. 2025-26 – UNBEATABLE COMBO. Order now from The BigBooks Store and get the latest taxation insights, amendments, and expert analysis in one powerful set.

![GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025 GSTJ's The Income Tax Act, 2025 [English-Hindi] Act No.30 of 2025 - 1th Edition 2025](uploaded_files/product/1758099911.jpg)