Commercial's Systematic Approach to Taxation Containing Income ( TAX & GST ) Applicable for May2026 to Jan 2027 - 51st Edition 2026

| Author : | COMMERCIAL`S |

|---|

-

Covers both Income Tax & GST in a single, cohesive textbook.

-

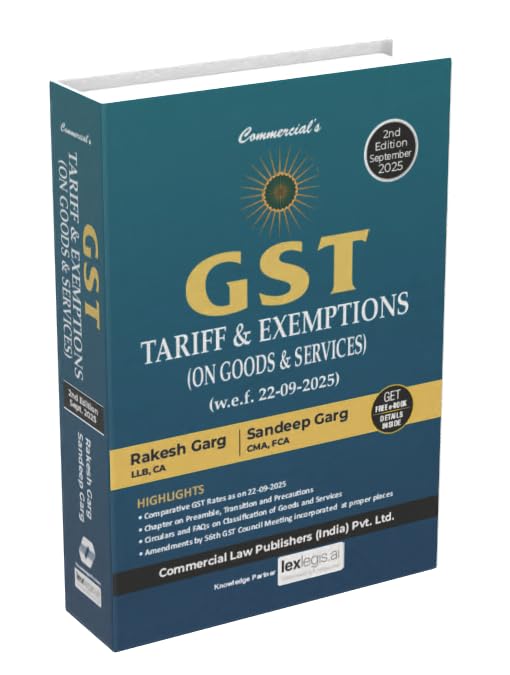

Latest legislative updates, notifications, and practical illustrations aligned with current academic requirements.

-

Designed to help with conceptual clarity, numerical problems, and exam preparation.

-

Suitable for students of CA Inter, CMA Inter, CS Executive, and related taxation studies.

If you want, I can provide ISBN, table of contents, or where to buy this edition online (with prices in India). Just let me know!

-

Comprehensive CA-Inter/CS/CMA reference covering both Income Tax and Goods & Services Tax (GST).

-

Updated for Assessment Year 2026–2027 (51st Edition) with latest laws and amendments current as of early 2026, tailored for exams like May/Sep 2026 and Jan 2027.

-

Structured in a systematic, exam-oriented format with clear conceptual explanations and plenty of practical illustrations/examples.

-

Ideal for CA Intermediate and other professional taxation courses.